Stock Market Crash Predictions 2025: Why The “Doomsday” Experts Are Almost Always Wrong

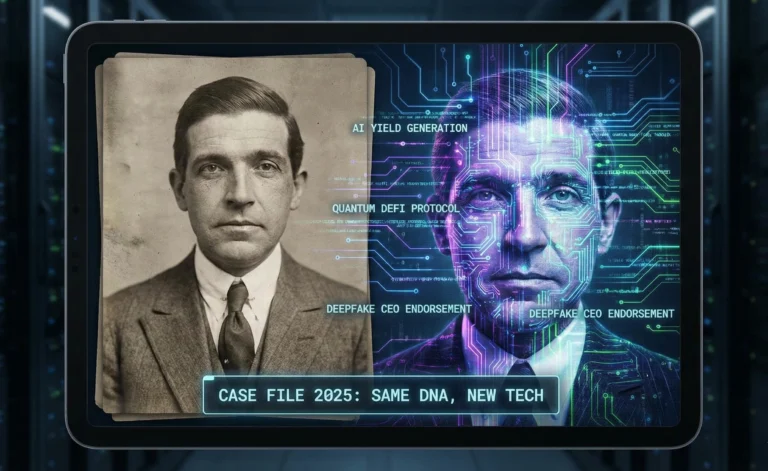

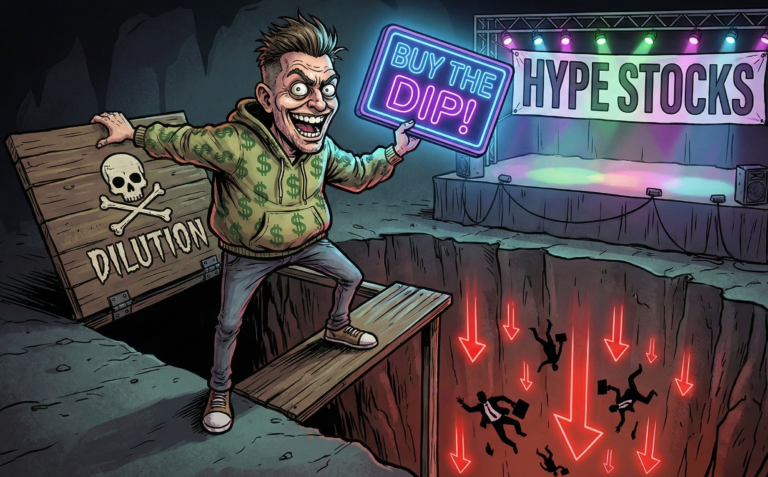

In the high-stakes world of finance, there is a persistent, profitable industry built on a single headline: “The Crash is Coming.” As we move through 2025, influential voices and viral social media clips are once again touting recession warnings, urging retail investors to move to cash before the “inevitable” collapse.

This alarmist rhetoric serves a primary purpose: to exploit investor anxiety. But as The Unpaid Analyst, I look at the math, not the media. The question isn’t just “is the stock market going to crash?”—it’s what it costs you to believe the people who say it will. By dissecting a decade of failed forecasts and comparing market timing vs buy and hold data, we see a clear pattern: the “Fear Industry” profits from your panic while you lose out on the greatest wealth-building machine in history.

The Psychology of Fear: Why We Search for “Is the Stock Market Going to Crash?”

The financial media thrives on sensationalism because fear is the ultimate engagement tool. Headlines engineered to provoke anxiety are not just news; they are products. This financial media fear mongering triggers our evolutionarily hardwired “negativity bias”—the same instinct that helped our ancestors survive predators now causes modern investors to sabotage their portfolios.

When you are bombarded with “doomsday” content, you fall into the trap of short-term thinking. You forsake decades of compounding for the illusion of immediate safety. In reality, the “Fear Industry” doesn’t get paid for being right; they get paid for your clicks. As the saying goes: “Fear sells faster than facts.”

Skeptic’s Sidebar: Expert “doomsdayers” have predicted 50 of the last 2 recessions. Their goal isn’t accuracy; it’s retention through constant anxiety. If they are right once every ten years, they are called “prophets.” If they are wrong for nine, they are simply ignored.

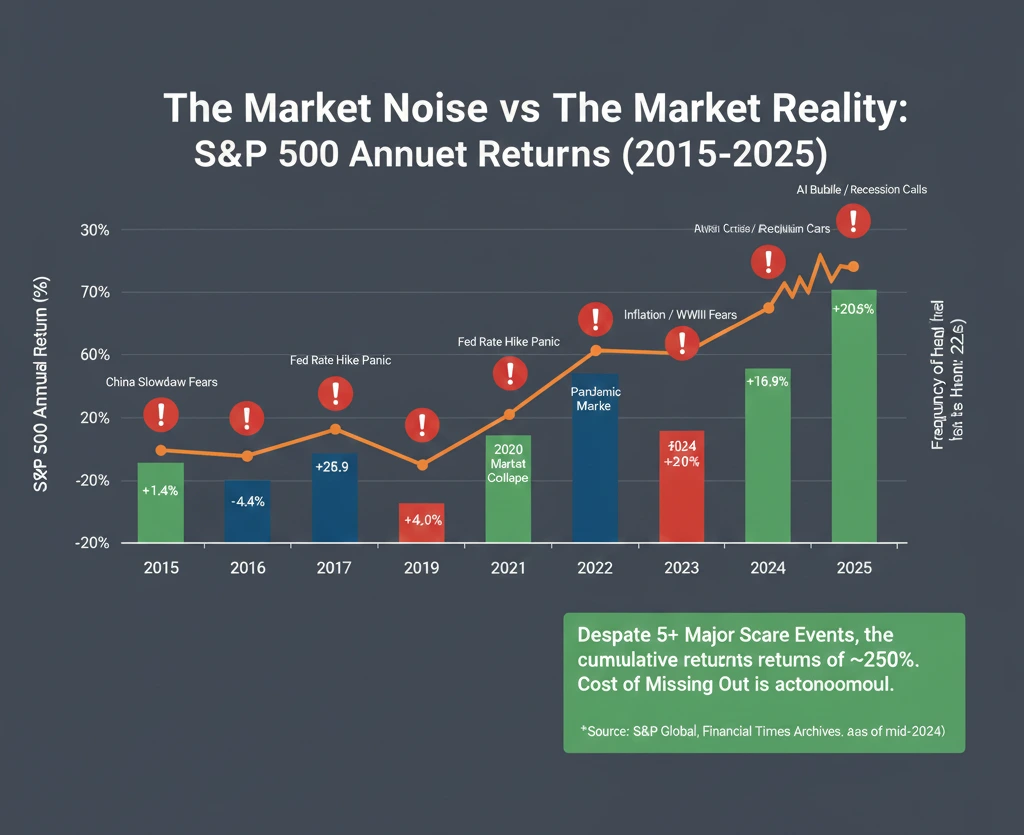

Data Analysis: 10 Years of Failed Predictions vs. S&P 500 Reality

To understand the accuracy of financial forecasters, we must look at the “predicted” disasters of the last decade. From 2016 to 2025, the narrative has always been that a crash is “imminent.”

|

Year |

The “Predicted Disaster” |

Actual Market Result (S&P 500) |

Outcome |

|---|---|---|---|

|

2016 |

Brexit & Election Chaos |

+12% |

Markets looked past the headlines. |

|

2018 |

Trade Wars / Fed Hikes |

-4% (Correction) |

Followed by a +29% rally in 2019. |

|

2020 |

Pandemic Lockdown |

+16% |

V-shaped recovery caught timers off-guard. |

|

2022 |

Peak Inflation / Ukraine |

-19% (Bear Market) |

Followed by a +24% “recovery” in 2023. |

|

2024 |

The “AI Bubble” Burst |

+23%+ |

Tech earnings drove record highs. |

|

2025 |

Tariff/Inflation Fears |

+15.5% (YTD) |

The market hit 40+ all-time highs this year. |

The Lesson: Even during years with significant pullbacks (2018, 2022), the recovery happened faster than the media could change their headlines. If you followed the recession warnings, you didn’t just avoid a dip; you missed a 77% cumulative surge since early 2023.

The Hidden Cost of Market Timing

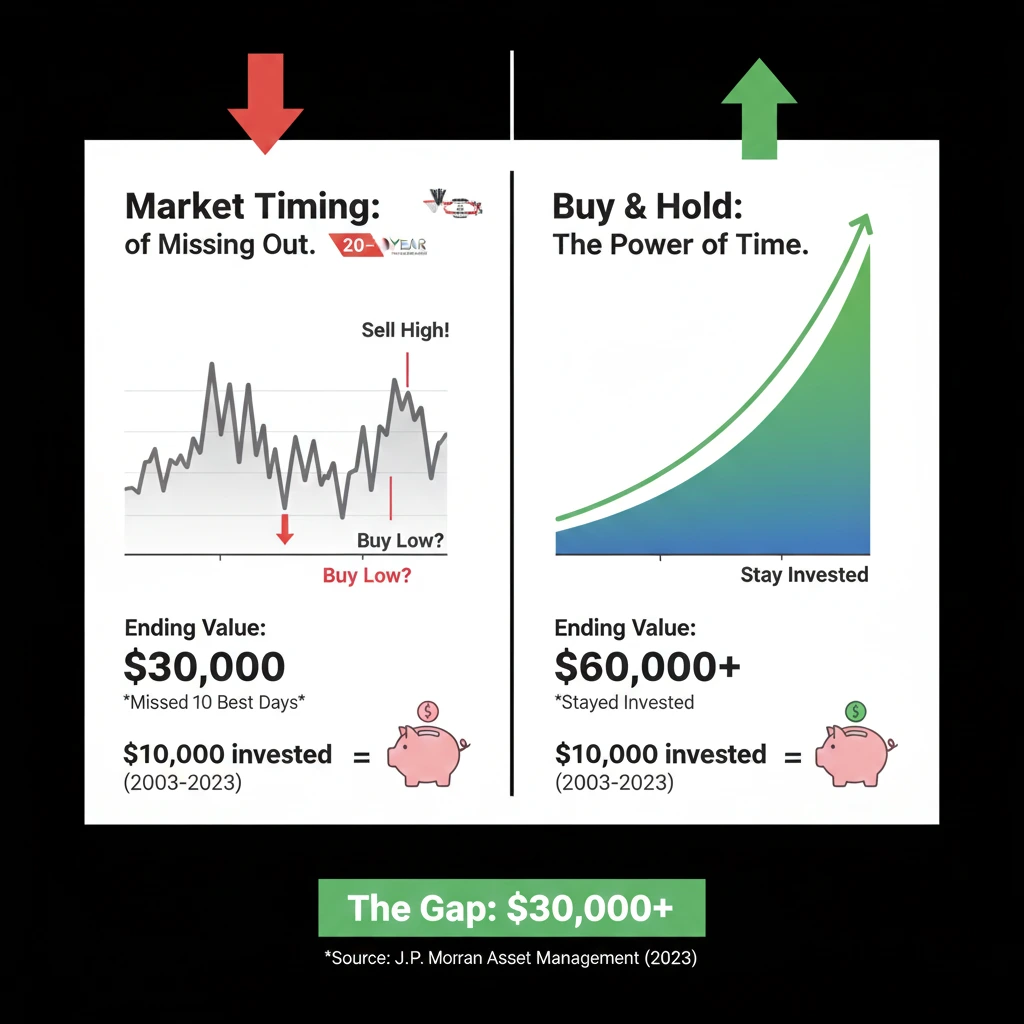

Most investors believe they can “sit out the crash” and buy back at the bottom. This is the deadliest myth in finance. The cost of market timing is mathematically devastating because of the “Best Days” phenomenon.

According to updated J.P. Morgan Asset Management data, a $10,000 investment in the S&P 500 over 20 years (2004–2024) would have grown to over $70,000 if you stayed fully invested.

The irony? Seven of the ten best days in stock market history occurred within 15 days of the ten worst days. If you sell during the panic, you are almost guaranteed to be on the sidelines during the recovery.

Market Timing vs. Buy and Hold: What the Math Actually Says

While timers attempt to outsmart the global economy, the buy and hold strategy embraces the market’s inherent unpredictability. Since its inception, the S&P 500 has delivered an average annual return of roughly 10%.

Surviving market volatility is not about having a crystal ball; it’s about having a iron stomach. A buy-and-hold strategy succeeds because:

- Compounding: Reinvested dividends do the heavy lifting while you sleep.

- Tax Efficiency: You avoid the “tax drag” of capital gains triggered by frequent trading.

- Human Error: It removes the need to be “right” twice (knowing when to exit and when to re-enter).

How to Ignore Stock Market Noise and Build a Bulletproof Portfolio

To build wealth in 2025 and beyond, you must move from a “reactive” investor to a “systemic” one. Here is how to ignore stock market noise:

- Automate Your Discipline: Use Dollar Cost Averaging (DCA). By investing the same amount every month, you naturally buy more shares when prices are low and fewer when they are high.

- Rebalance, Don’t Retreat: If your portfolio is too “risky,” adjust your asset allocation (stocks vs. bonds) instead of exiting the market entirely.

- Focus on Quality: Invest in companies with strong cash flows and “moats.” These entities survive recessions while the “hype” stocks vanish.

- Set “Information Diets”: Stop checking your portfolio daily. The more often you check, the more likely you are to react to temporary volatility.

Conclusion: The Unpaid Analyst Takeaway

The stock market is a machine that transfers wealth from the impatient to the patient. The stock market crash predictions of 2025 may eventually come true—at some point, a correction will happen. But the math is undeniable: Time in the market beats timing the market.

The stock market crash predictions of 2025 may eventually come true—corrections are a natural part of a healthy system. However, while the media obsesses over a temporary dip in equity prices, they are completely ignoring the structural decay in the housing market. Before you assume your home is a safer ‘vault’ than your brokerage account, read our rotting asset thesis and real estate depreciation audit to see why your biggest investment might be the one actually facing a silent collapse.”

The next time a “prophet” tells you the end is near, remember that they are selling a narrative, while the market is selling growth. Stay disciplined, stay invested, and let the compounding begin.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment