Get-Rich-Quick Scheme Red Flags: The 3 Patterns That Guarantee Failure

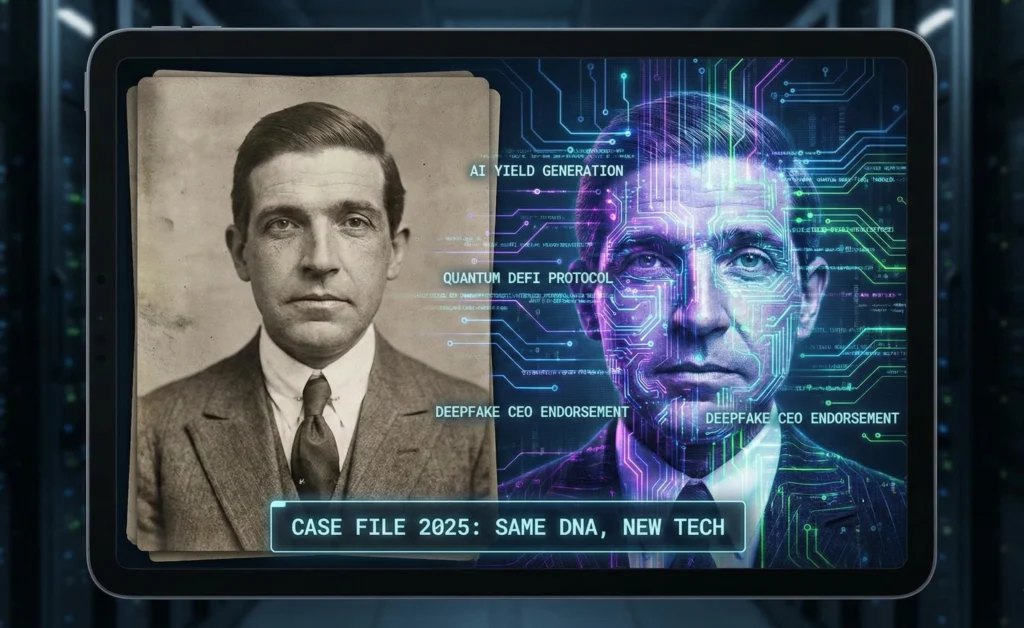

As we close out 2025, the human desire for effortless wealth remains unchanged, but the machinery designed to exploit that desire has received a terrifying upgrade. We have moved past the era of obvious Nigerian prince emails and clunky Photoshop jobs. Today’s financial scam patterns are powered by generative AI, hyper-realistic deepfakes of trusted financial figures, and decentralized finance (DeFi) protocols so complex they make quantum physics look like basic addition.

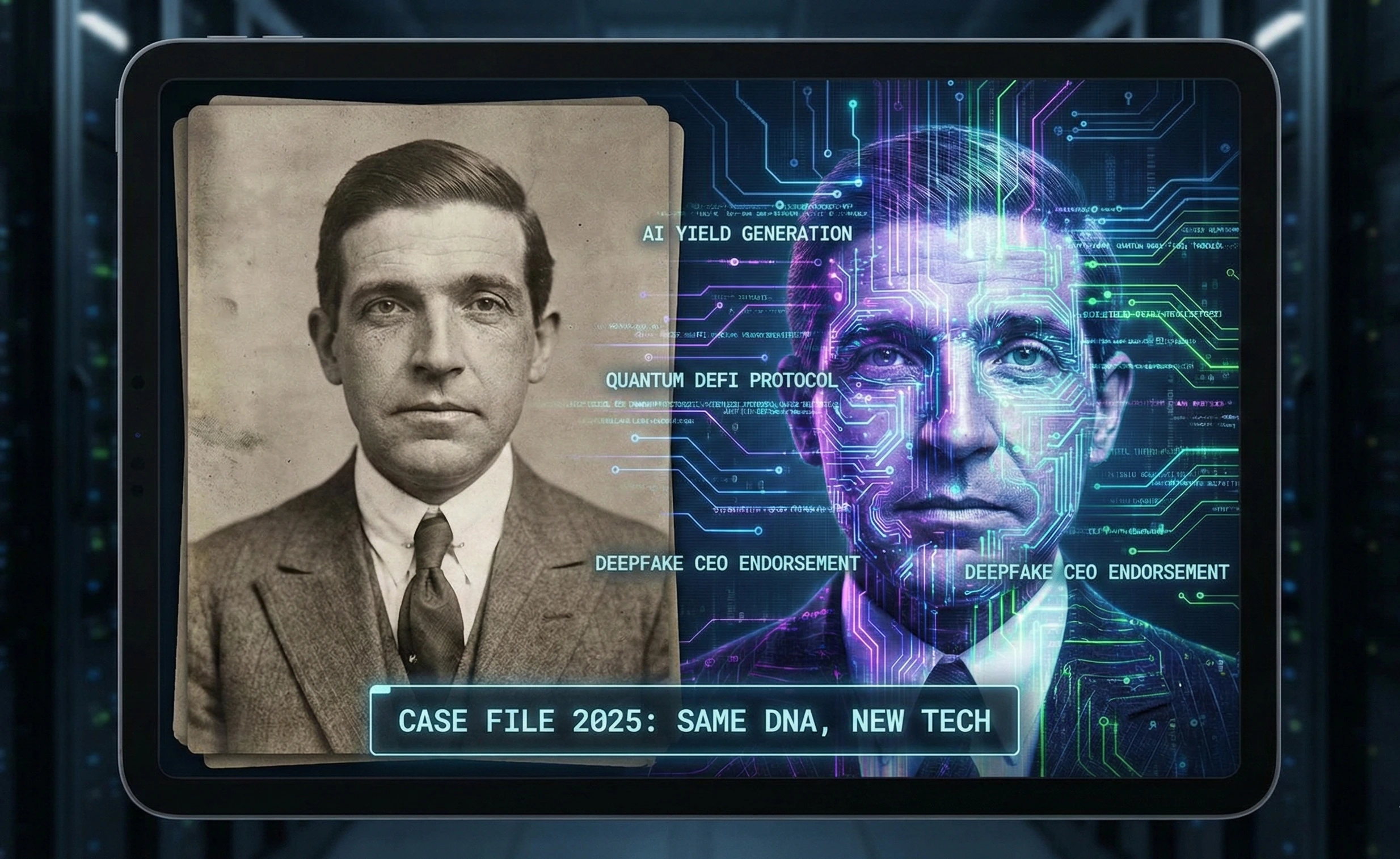

Yet, despite the dazzling technological veneer of 2025’s fraud landscape, the underlying “DNA” of these schemes hasn’t changed since Charles Ponzi was selling postal coupons in the 1920s. They all rely on the same mathematical impossibilities and psychological triggers.

The financial media often focuses on the victims’ stories after the collapse. As The Unpaid Analyst, my focus is on the mechanics before the collapse. By understanding the cash flow structures of legitimate businesses versus fraud, you can inoculate yourself against the sophisticated get-rich-quick scheme red flags proliferating on your social feeds. If you know how to identify a Ponzi scheme by its math rather than its marketing, you become un-scammable.

The Math of Impossibility: Why “Guaranteed Returns” Always Fail

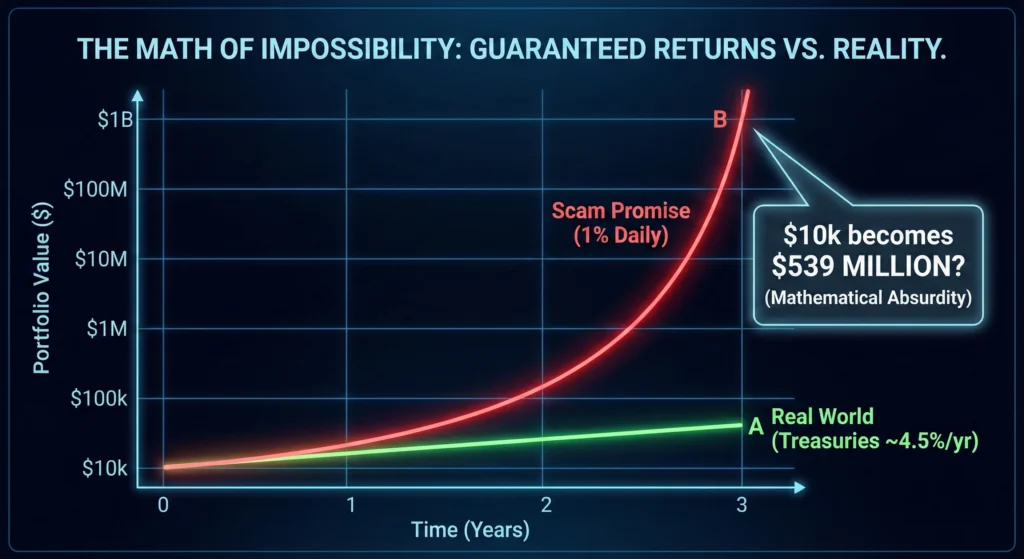

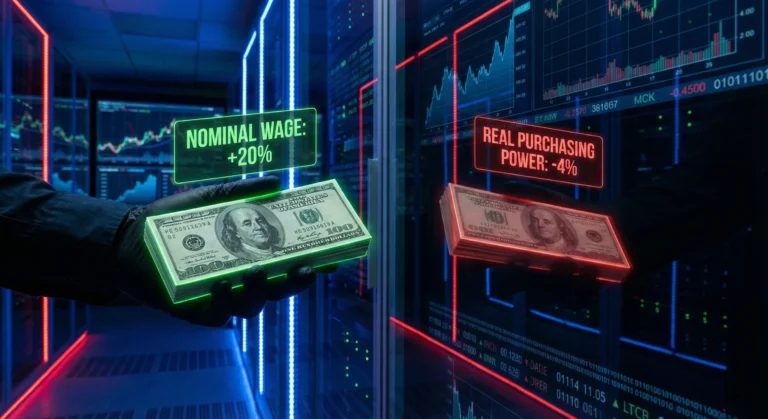

The single greatest indicator of financial fraud in any era is the promise of high, risk-free returns. In the investment world, “risk” and “reward” are inherently tied together. You cannot have one without the other.

To understand why the guaranteed investment returns myth is mathematically unsound, we need a baseline for reality in late 2025. Currently, the “risk-free rate”—essentially what you can get from holding short-term U.S. Treasuries—hovers around 4.5%. That is what the market pays you for taking almost zero risk.

Now, consider a typical 2025-era scam: an “AI-powered arbitrage trading bot” that guarantees 1% daily returns.

To the untrained eye, 1% a day sounds fantastic but manageable. Let’s apply the math of compounding to that claim. If you invested $10,000 at 1% daily compound interest, within one year, you would have approximately $377,834. Within three years, that $10,000 would grow to over $539 million.

If such a mechanism existed, the creator would not be selling access to you for a $500 subscription fee on Telegram. They would quietly become the wealthiest entity on the planet within a decade, absorbing the entire global GDP.

Skeptic’s Sidebar: If an investment opportunity claims to have “solved” the market with a proprietary AI algorithm that never loses, ask yourself one question: Why do they need my money? True money-printing machines are never shared; they are fiercely guarded secrets.

When a platform offers returns that significantly exceed the market average with “zero risk,” it is not an investment strategy. It is a wealth transfer mechanism—usually transferring wealth from latecomers to early adopters, until the music stops.

Case Study DNA: Analyzing the Patterns of Ponzi vs. Legitimate Structures

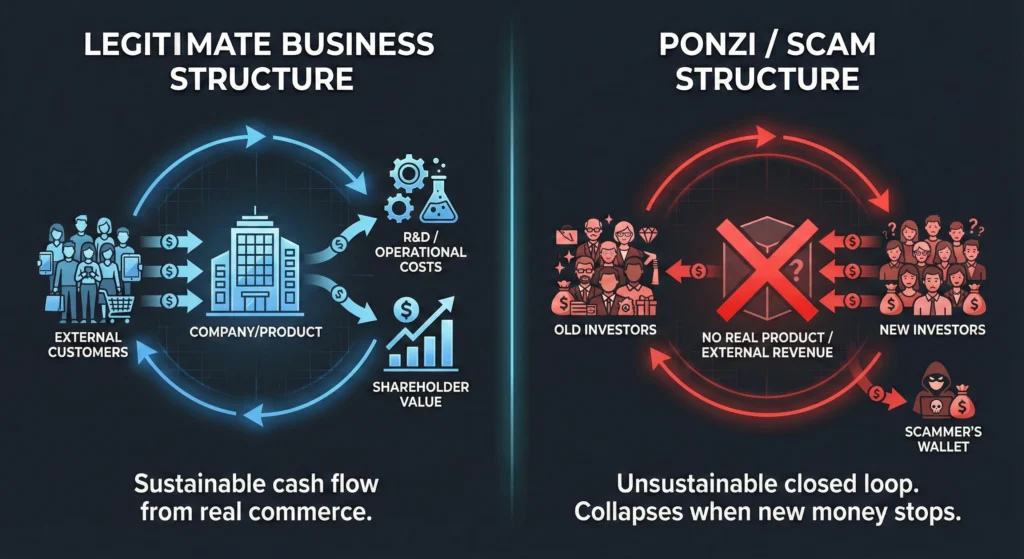

The fundamental difference between a real business and a scam is the source of the cash flow. A legitimate business thrives on external revenue (customers buying products). A scam thrives on internal revenue (new investors paying off old investors).

In 2025, scammers hide this lack of external revenue behind buzzwords like “staking rewards,” “liquidity mining,” or “algorithmic yield generation.” To cut through the noise, we must audit the cash flow DNA.

The Cash Flow Audit Table: Where Does the Money Come From?

|

Metric |

Legitimate Business (e.g., Nvidia, Apple) |

Ponzi / Pyramid / High-Yield Scam |

|---|---|---|

|

Primary Revenue Source |

Selling goods or services to external customers who are not investors in the company. |

The principal capital deposited by new participants entering the scheme. |

|

The “Product” |

A tangible good (iPhone) or service (AI chip computing power) that has inherent market value. |

Often vaporware, overpriced education packages, or a “token” with no utility outside the scheme itself. |

|

Sustainability |

Sustainable as long as customers value the product above its cost of production. |

Unsustainable mathematically. It requires an exponential supply of new victims to maintain payouts. |

|

Reaction to Withdrawals |

Routine. Companies keep cash reserves for operational needs and shareholder dividends. |

Panic. The scheme collapses immediately once the rate of withdrawals exceeds the rate of new deposits (a “run on the bank”). |

If you cannot clearly identify who the “external customer” is, the customer is you.

Red Flag #1: The Lack of an External Revenue Source (The Closed Loop)

This is the deadliest of all financial scam patterns. In 2025, this often manifests in the crypto space as “yield farming” platforms where you stake Token A to earn rewards paid in Token B, which you then restake to earn Token C.

The entire ecosystem is a closed loop. There is no external cash entering the system—no one is buying groceries, paying for software, or purchasing fuel with these tokens. The “value” is purely speculative, driven by the belief that someone else will come along later to buy the tokens at a higher price.

When we perform a multi-level marketing (MLM) cash flow analysis, we see the same pattern in a different wrapper. Aggressive MLMs often push overpriced products (supplements, essential oils, or digital courses) that have almost no retail viability outside the distributor network.

According to data from the FTC, over 99% of participants in aggressive MLMs lose money. Why? Because the math is rigged. The income isn’t derived from selling products to real customers; it’s derived from recruiting new distributors who are forced to buy inventory to remain “active.”

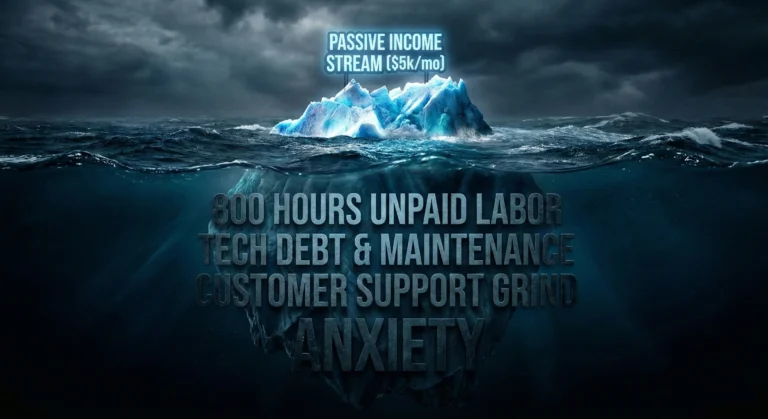

This same predatory math is currently being repackaged for 2026 as ‘high-ticket coaching.’ Before you drop thousands on a ‘mastermind’ that promises to escape the matrix, you should see our forensic coaching course fee audit to understand why the ROI on these programs is often a statistical impossibility once you account for the stealth fees and opportunity costs.”

Ultimately, whether it’s a course or a coin, you must apply the 2026 Litmus Test: If the investment opportunity stopped accepting new investors tomorrow, could it still generate the promised returns using its existing business operations? If the answer is no, it’s a Ponzi, regardless of whether it uses dollars or digital assets.”

Red Flag #2: The Use of Deepfake Social Proof and Fake Testimonials

Scammers know that human beings are herd animals. We look to others—especially perceived authority figures or those signaling extreme wealth—to decide what is safe. In the past, fake testimonial identification meant spotting bad acting in low-budget videos.

In 2025, the threat has evolved significantly due to generative AI. We are now seeing a proliferation of “deepfake financial endorsements.” Scammers are using AI video tools to create hyper-realistic videos of trusted figures—think Warren Buffett, Jamie Dimon, or popular financial YouTubers—appearing to endorse a specific trading platform or crypto token.

These deepfakes are often paired with rented displays of wealth: influencers posing in rented private jets or mansions, flashing screenshots of “wallet balances” that can be easily forged in a web browser’s developer console.

Skeptic’s Sidebar: The louder the lifestyle flexing, the quieter the actual business model. Real wealth whispers; investment scams scream. If the marketing focuses more on the Lamborghinis you could buy rather than the mechanics of how the money is made, run away.

This psychological warfare is designed to bypass your prefrontal cortex (the logical part of your brain) and trigger your FOMO (fear of missing out). They don’t want you to do the math; they want you to dream about the yacht.

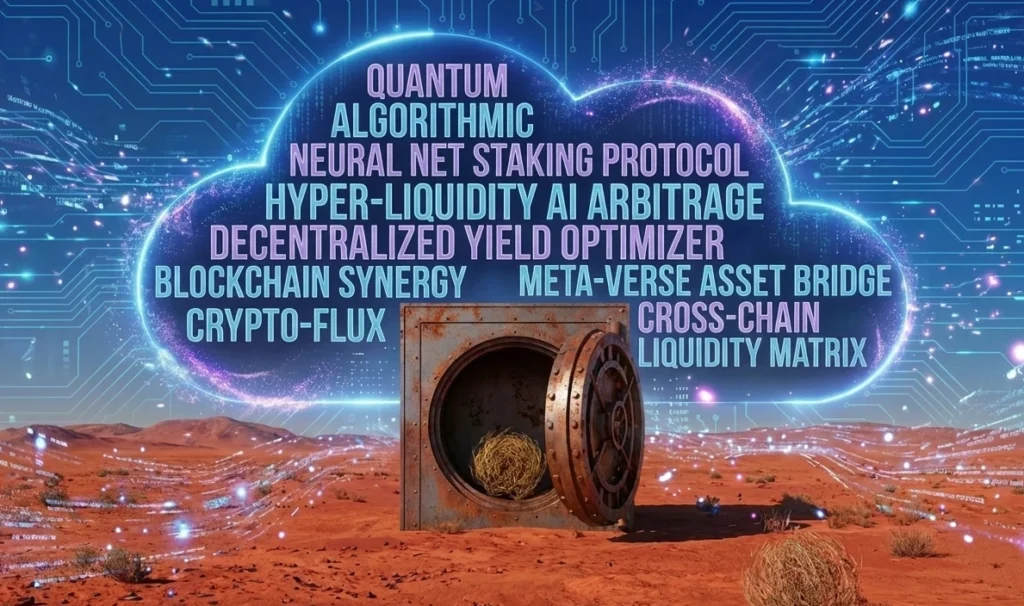

Red Flag #3: Complexity as a Smoke Screen for Insolvency

The final red flag is the deliberate use of overwhelming complexity to hide the lack of a viable business model. In 2025, the preferred smoke screen involves Artificial Intelligence and quantum computing buzzwords.

You will read whitepapers describing “proprietary, quantum-resistant AI neural nets that execute micro-arbitrage trades across decentralized exchanges at light speed.”

When you ask for proof of these trades or an audit of the algorithm, you are told it is “intellectual property” that cannot be shared. This complexity is a feature, not a bug. It is designed to make you feel intellectually inferior, causing you to defer judgment to the “geniuses” running the platform.

A legitimate investment strategy, no matter how complex the execution, can usually be explained in a simple sentence. Warren Buffett buys undervalued companies with strong cash flows. A real estate investor buys properties where rental income exceeds expenses.

If the explanation of how the yield is generated requires a PhD in computer science to understand—and the creators refuse to simplify it or provide third-party audits—it is because there is no underlying mechanism other than shuffling new investor money to old investors. The buzzwords are just a modern curtain for the Wizard of Oz.

Risk Management: How to Audit an Opportunity in 10 Minutes

You don’t need to be a forensic accountant to spot these get-rich-quick scheme red flags. In the current 2025 environment, a 10-minute due diligence audit can save you your life savings.

- The Reverse Image Search Test Take the photos of the “CEO” or “Founder” from the project’s “About Us” page and run them through a reverse image search engine (like Google Images or TinEye). In 2025, many scam sites use AI-generated faces for their “team” that do not exist in reality, or they use stock photos of random people.

- The Regulatory Check (The EDGAR Test) If an investment is offering securities to U.S. citizens, they generally need to be registered with the SEC. Go to the SEC’s EDGAR database and search for the company name. If they are raising millions of dollars but have zero regulatory footprint, that is a massive unregulated investment risk.

- The Liquidity Check (For Crypto/DeFi) If the project is in the crypto space, don’t trust the “Total Value Locked” (TVL) numbers on their website. Use a third-party blockchain explorer like Etherscan to look at the actual contract addresses. Are the funds actually there? Is the liquidity “locked,” or can the developers drain the pool at any moment (a classic “rug pull”)?

Conclusion: The Unpaid Analyst Takeaway

The tools of fraud have evolved, but the victims are the same: people who desperately want to believe there is a shortcut to wealth that “they” (the elites, the banks, the institutions) are hiding from you.

The uncomfortable truth, which I will repeat until I am hoarse, is that real wealth building is boring. It is slow. It involves buying productive assets, managing risk, and letting compound interest work over decades, not days.

Scammers are selling you a lottery ticket disguised as an investment. They are preying on your economic anxiety and your hope. The best defense in 2025 is a healthy dose of profound skepticism. If an opportunity sounds too good to be true, it is not a unicorn; it is a financial landmine. Keep your money boring, and keep it safe.

Disclaimer: The views expressed here are for informational purposes only and should not be considered individual financial advice. The Unpaid Analyst is not a registered financial advisor. Always do your own due diligence or consult a certified professional before investing.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment