The Index Fund Delusion: Why the S&P 500 Won’t Make You Filthy Rich in 2026

As we step into 2026, the “New Year, New Wealth” resolutions are in full swing. Financial influencers are flooding feeds with charts of the S&P 500, promising that “lazy investing” is your golden ticket to a private island. They point to the double-digit returns of 2024 and 2025 as proof that the index is a magic money tree.

But here is the index fund wealth-building myth that nobody wants to tell you: The S&P 500 is where you stay rich; it is rarely where you get rich.

If you are entering 2026 expecting an index fund to turn a modest monthly contribution into a fortune by 2030, you aren’t an investor—you’re a victim of a math error. To navigate the realistic stock market returns 2026 has to offer, we must strip away the “Boglehead” dogma and look at the S&P 500 compound interest reality.

In this analysis, we will forensically audit the index fund structure. We will see why it is a defensive shield—a reliable tractor designed to protect your purchasing power—rather than the offensive Lamborghini everyone claims it is.

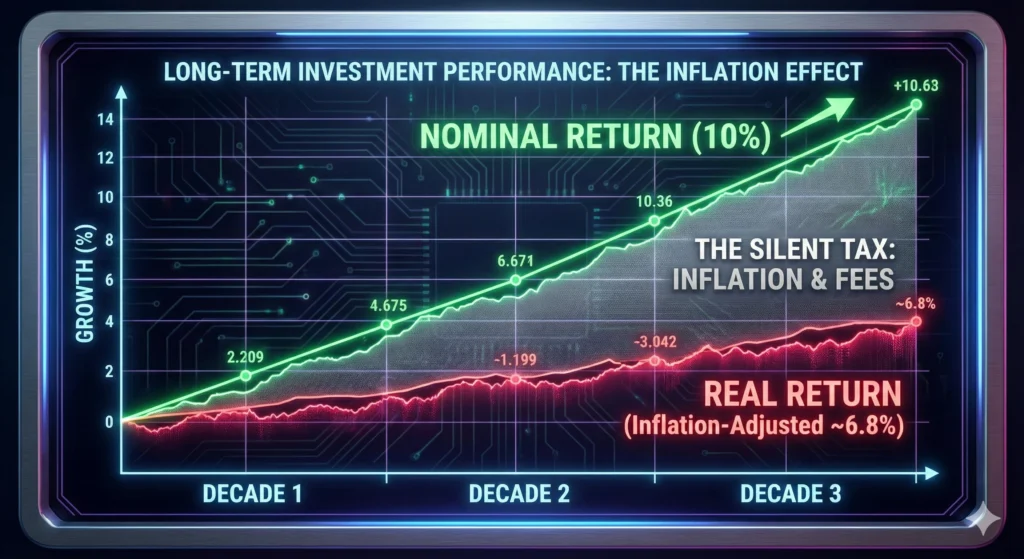

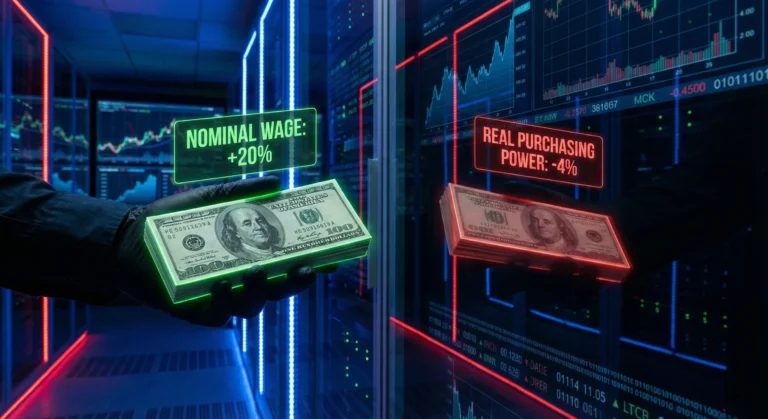

The Math of Mediocrity: Real Returns vs. Nominal Hype

The most dangerous number in finance is “10%.” That is the historical average annual return of the S&P 500 over the last century. It’s a beautiful number. It’s easy to plug into a calculator. It’s also a total delusion.

To understand is index fund investing worth it in 2026, you have to look at “Real Returns.”

- Nominal Return: 10% (The “Headline” number).

- Inflation Tax: ~3.2% (The silent thief that erodes what a dollar actually buys).

- Taxes & Fees: ~1.5% (Capital gains and the “hidden” slippage of even low-fee funds).

- Actual Real Return: ~5.3% to 6.8%.

When you account for the cost of living in 2026, your money isn’t growing at 10%; it’s growing at a pace that doubles your purchasing power every 10.5 to 13 years. That is progress, but it isn’t a “get-rich-quick” scheme.

Skeptic’s Sidebar: If your financial plan relies on a 10% return to retire, you have built a house on sand. Inflation doesn’t care about your spreadsheet; it eats your future purchasing power for breakfast.

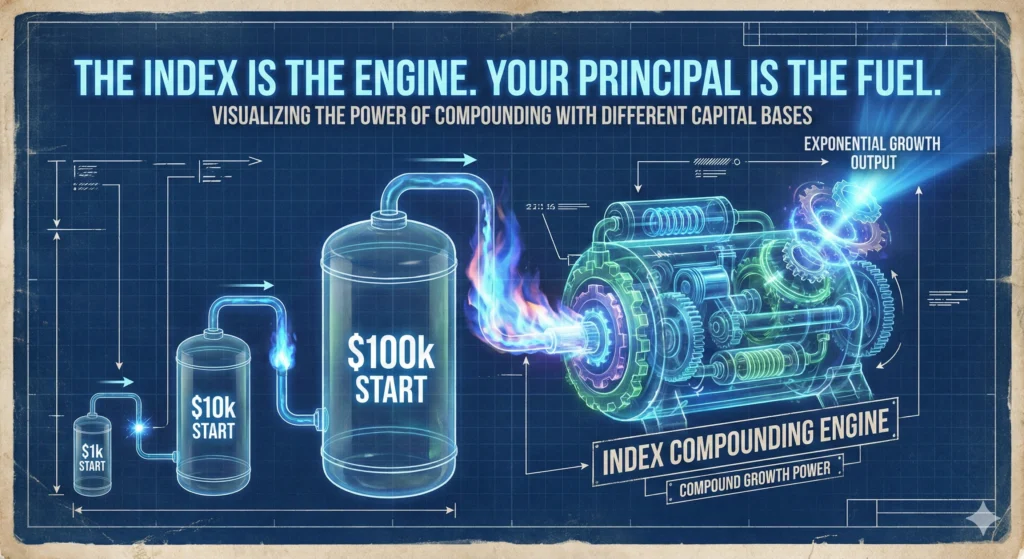

Principal Matters: The “It Takes Money to Make Money” Rule

The “Fear Industry” tells you to worry about a crash. The “Hope Industry” tells you to worry about missing the bull run. As The Unpaid Analyst, I tell you to worry about your Principal.

The S&P 500 is a multiplier of capital, not a generator of capital. If you have no capital to multiply, the math of compounding works against your lifespan.

|

Investment Period (20 Years) |

Starting Principal |

Monthly Contribution |

Final Inflation-Adjusted Value (7% Real) |

|---|---|---|---|

|

The “Hopeful” Investor |

$1,000 |

$200 |

$105,820 |

|

The “Mid-Tier” Investor |

$10,000 |

$1,000 |

$552,400 |

|

The “Unpaid Analyst” Target |

$100,000 |

$5,000 |

$2,895,000 |

Look at the “Hopeful” Investor. After 20 years of discipline, they have $105k in 2046 dollars. Given the S&P 500 historical performance vs inflation, that $105k will likely buy what $50k buys today. It’s a safety net, but it isn’t wealth.

The index fund only becomes a wealth machine once you have already done the hard work of Active Income generation. It is an offensive play for the rich and a defensive play for the rest.

The Defensive Play: Surviving vs. Thriving

Why is the S&P 500 so popular? Because it has a built-in “Survivorship Bias.” The index automatically kicks out the losers and adds the winners. It is, by definition, a defensive investment strategy.

By owning the index, you are guaranteed to own the next Apple or Nvidia. But you are also guaranteed to own the hundreds of stagnant companies that drag down the average. This is the tractor of finance: it will get you across the field regardless of the weather, but it will never win a drag race.

By owning the ‘basket,’ you are essentially forced to subsidize failing business models and overvalued hype-trains. Many of these index laggards stay afloat only by using retail capital as a liquidity exit for insiders and venture capitalists who are dumping shares of insolvent companies before the debt cycle resets. If you don’t know which companies in your index are actually ‘zombies,’ you aren’t an investor—you’re the exit strategy.”

In 2026, with valuations at historic highs, the S&P 500 is a tool for wealth preservation. It ensures you don’t lose to the “slow death” of cash. But if you want wealth creation, you are in the wrong asset class.

Opportunity Cost: What You Give Up for “Safety”

The opportunity cost of index funds is the “Alpha” you leave on the table. When you buy the “basket,” you surrender the ability to make a life-changing bet on a concentrated asset.

In 2026, the “safety” of the index is expensive. With a high Price-to-Earnings (P/E) ratio across the board, you are paying a premium for a defensive play.

Surviving the Sideways Market: The 2026 Outlook

What are the realistic stock market returns 2026 can provide?

We are coming off a period of unprecedented liquidity. The “New Year Opportunity” isn’t a miraculous surge; it’s the realization that we may be entering a “Sideways Decade.” If the index stays flat for five years while inflation runs at 3%, you have lost 15% of your wealth while “holding steady.”

This is why portfolio growth vs principal size is so critical. If your contributions are small, a sideways market will demotivate you. If your principal is large, a sideways market is a threat to your lifestyle.

Conclusion: The Unpaid Analyst Takeaway

The S&P 500 is not a scam, but the way it is sold to retail investors in 2026 is a delusion.

It is a fantastic tool for wealth preservation vs wealth creation. If you have $1M, the S&P 500 is how you make sure your grandkids have $1M. If you have $1,000, the S&P 500 is a distraction from the real task: increasing your active income.

The index fund wealth-building myth relies on you ignoring the passage of time and the erosion of inflation. In 2026, my advice remains contrarian: Stop obsessing over the “perfect” index fund and start obsessing over how to put more fuel (principal) into the engine.

The S&P 500 is where you stay rich. Your skills and your business are where you get rich.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment