The Great Resignation Myth: Why Your 20% Raise Was Actually a Pay Cut

If you look at your W-2s from 2021 through 2025, you might feel a fleeting sense of accomplishment. On paper, you are likely making more money than ever before. The post-pandemic era, fueled by the narrative of the “Great Resignation,” saw workers seizing power, demanding double-digit raises, and hopping jobs for massive salary bumps. The mainstream media story was clear: The worker had finally won.

But here is the cold, forensic truth that “Boglehead” influencers and government statisticians won’t tell you: You are likely poorer today than you were in 2020.

The victory was a mathematical illusion. While you were celebrating a bigger paycheck, an unseen hand—inflation—was quietly stealing your purchasing power from the other side of the ledger. This is not a philosophical debate; it is a clinical audit of real wage growth vs inflation 2026.

For millions of workers, the so-called “Great Resignation” was nothing more than a collective hallucination of progress, masking a deep, structural, and permanent stealth pay cut.

The Money Illusion: Your 20% Raise vs. The Reality Trap

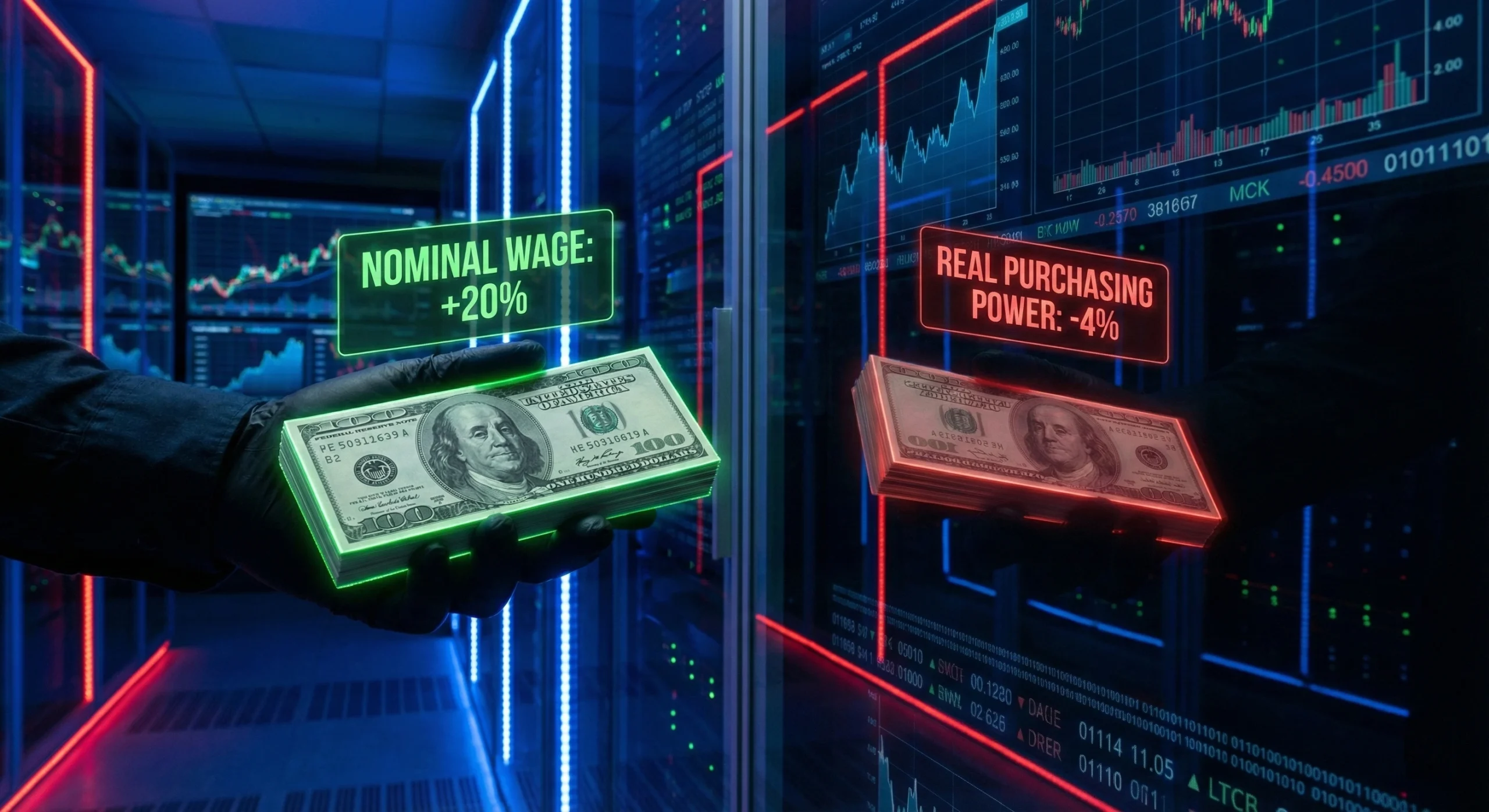

Economists call this phenomenon the “Money Illusion.” It is the human tendency to think of currency in nominal terms—the literal number on your check—rather than in real terms—the volume of goods and services that check can actually command.

Your boss gave you a 5% raise in 2024. You felt good. You celebrated. But if the cost of your “captive” expenses (rent, insurance, utilities) rose by 8%, you didn’t get a raise; you received a 3% penalty for the privilege of showing up to work.

Skeptic’s Sidebar: A raise is not a win until it beats your personal inflation rate. The CPI is a national average of a “ghost” consumer. Your budget is a ledger. Models don’t pay bills; cash flow does

The nominal vs real income gap is the defining financial struggle of 2026. The extra zeros in your bank account are meaningless if the price of a gallon of milk, a car insurance premium, and a kilowatt-hour of electricity has outpaced them.

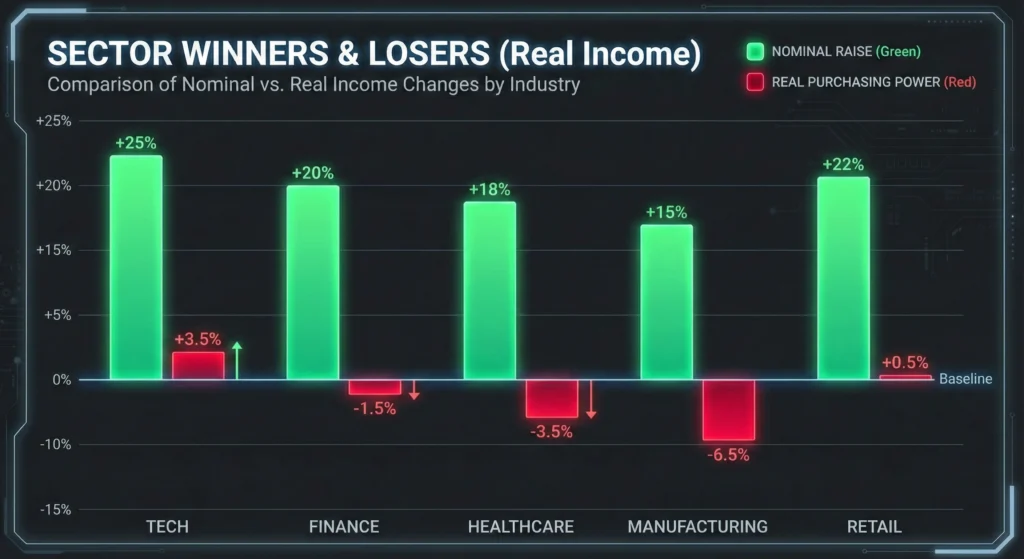

Data Deep-Dive: Sector Wage Growth vs. The Real CPI

Let’s strip away the vibes and look at the spread. Below is a forensic comparison of nominal wage growth in key sectors during the “Great Resignation” peak against the cumulative inflation impact.

(Data Note: Adjusted for a cumulative 22%–25% “real-world” inflation impact from 2021–2025 using a weighted basket of non-discretionary services.)

Sector Wage Growth vs. Inflation (2021–2025)

|

Industry Sector |

Nominal Raise (Cumulative) |

Real Purchasing Power Change |

Net Result |

|---|---|---|---|

|

Technology |

+25% |

+3.5% |

Flat/Treading Water |

|

Finance |

+20% |

-1.5% |

Slight Loss |

|

Healthcare |

+18% |

-3.5% |

Clear Pay Cut |

|

Manufacturing |

+15% |

-6.5% |

Major Pay Cut |

|

Retail/Hospitality |

+22% |

+0.5% |

Stagnant |

The table reveals the ugly truth. While tech workers who aggressively job-hopped managed to stay roughly even with the cost of living, the vast majority of the workforce saw a significant, permanent reduction in their standard of living. The numbers went up, but the lifestyle ROI went down.

Why Official CPI Lies to You: The Three Pillars of Deception

If official data says inflation is cooling, why does your life still feel like a financial emergency? Because the Consumer Price Index (CPI) is a flawed, politically convenient metric. The CPI vs real world inflation gap exists for three structural reasons:

- Hedonic Adjustments: CPI adjusts prices downward for “improved quality.” If your new phone is 20% faster, the government argues its price didn’t really go up, even if you paid $200 more. You can’t pay your landlord with “processor speed.”

- Substitution Bias: CPI assumes that if steak gets too expensive, you’ll happily eat chicken. If chicken gets expensive, you’ll eat beans. This is statistically coherent but practically offensive: Substitution is just a fancy word for “downgrading your life.”

- Sticky Services: CPI often lags on the biggest costs—insurance and rent resets. In 2026, we are seeing “Service Inflation” (medical, insurance, utilities) stay structurally higher than the “Goods Inflation” (TVs, toys) that headlines focus on

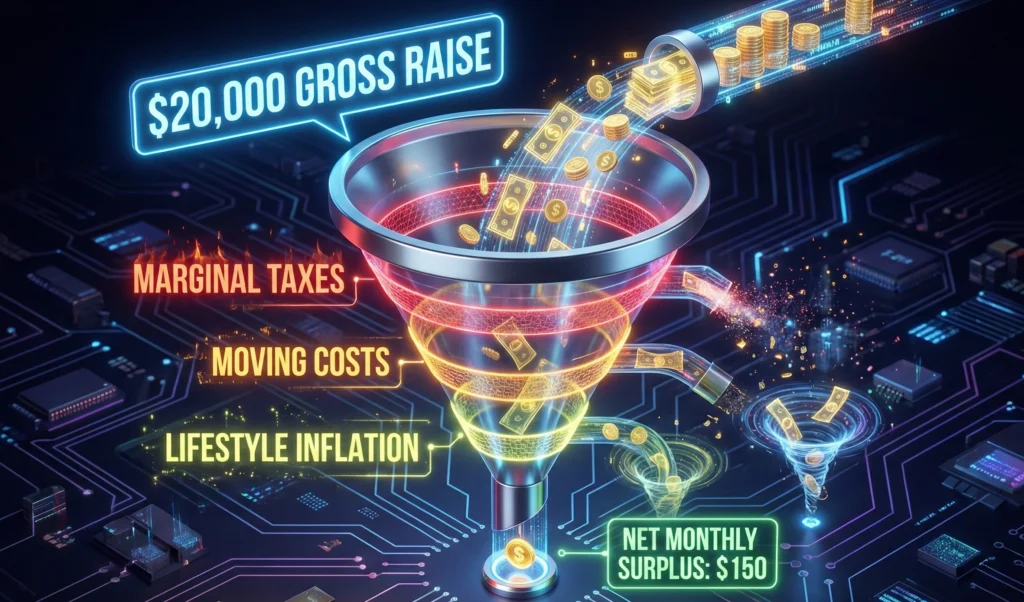

The “Purchasing Power Loss Calculator” (The 5-Minute Audit)

You don’t need a PhD; you need a sober spreadsheet. Use this framework to see if you actually “won” your last career move.

- The Nominal Raise: (New Salary – Old Salary) / Old Salary. Example: $80k to $96k = 20%.

- The Tax Bite: Your raise is taxed at your marginal (highest) rate. If you are in the 24% bracket + state taxes, your 20% raise is actually a 14% take-home increase.

- Personal Inflation: Calculate the increase in your “Captive Costs” (Rent/Mortgage + Insurance + Utilities + Food). For most, this was 18%–22% cumulative since 2021.

- The Net Result: If your after-tax raise is 14% and your costs rose 20%, your standard of living dropped by 6%.

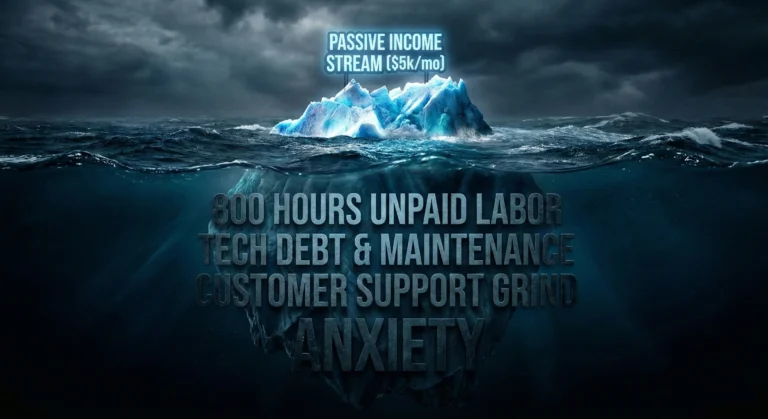

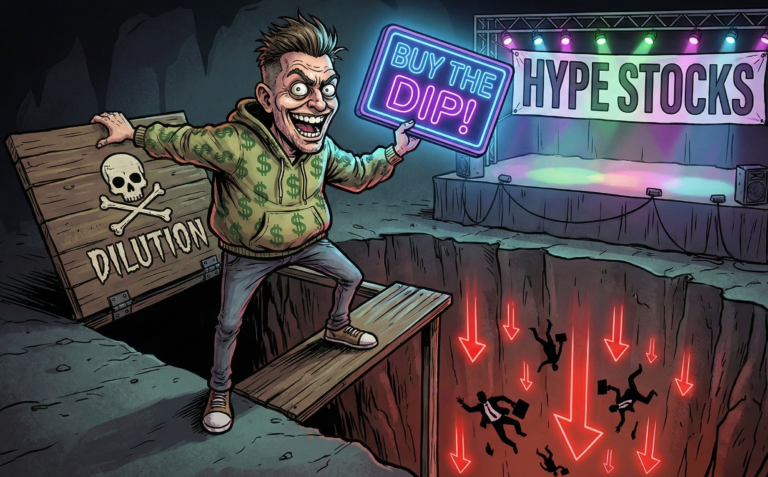

The Cost of Mobility: Career Hopping and Stealth Expenses

The Great Resignation was marketed as a career mobility ROI story. But many who jumped ship found that the “jump” came with stealth costs that ate the raise:

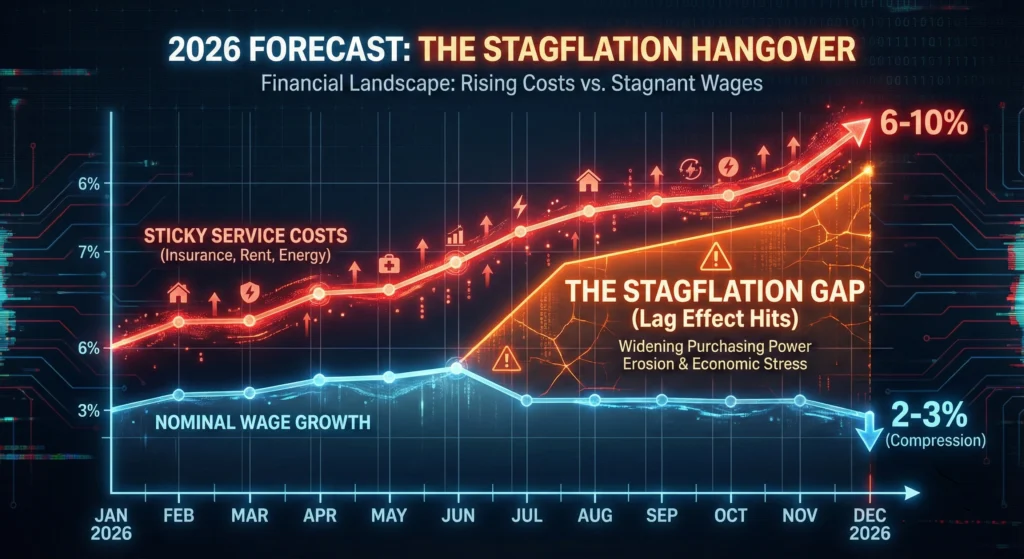

2026 Forecast: The Stagflation Hangover

As of January 4, 2026, we have entered the “Lag Effect” phase. The rapid interest rate cycles of 2024–2025 are finally hitting the labor market.Forecast: Through the end of 2026, expect nominal wage growth to compress to 2%–3% while non-discretionary services (insurance, energy, healthcare) continue to reprice upward at 6%–10%. The real wage growth vs inflation 2026 will likely stay negative for the middle class. We aren’t looking at a “spike”; we are looking at a relentless, slow grind that drains bank accounts over time.

Conclusion: The Unpaid Analyst Takeaway

The “Great Resignation” will go down in history as the greatest act of financial gaslighting of the 21st century. Millions were convinced they were “winning” while their financial foundations were being liquidated.

If you want to survive 2026, stop playing the “nominal game.”

Don’t let the number on your paycheck fool you. If your raise is less than the price of a carton of eggs and a gallon of gas, you aren’t an investor in your future—you’re a victim of the math.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment