The Liquidity Exit: 4 Forensic Metrics Influencers Hide While Hyping ‘Hot’ Stocks

If you open your social feeds on this morning of January 15, 2026, you will see the usual parade of “Finfluencers” screaming about the next AI revolution or quantum computing breakthrough. They promise you 100x returns. They tell you, “this time is different.”

They are lying. Or, at best, they are useful idiots for a machine designed to transfer wealth from your 401(k) to a venture capitalist’s yacht fund.

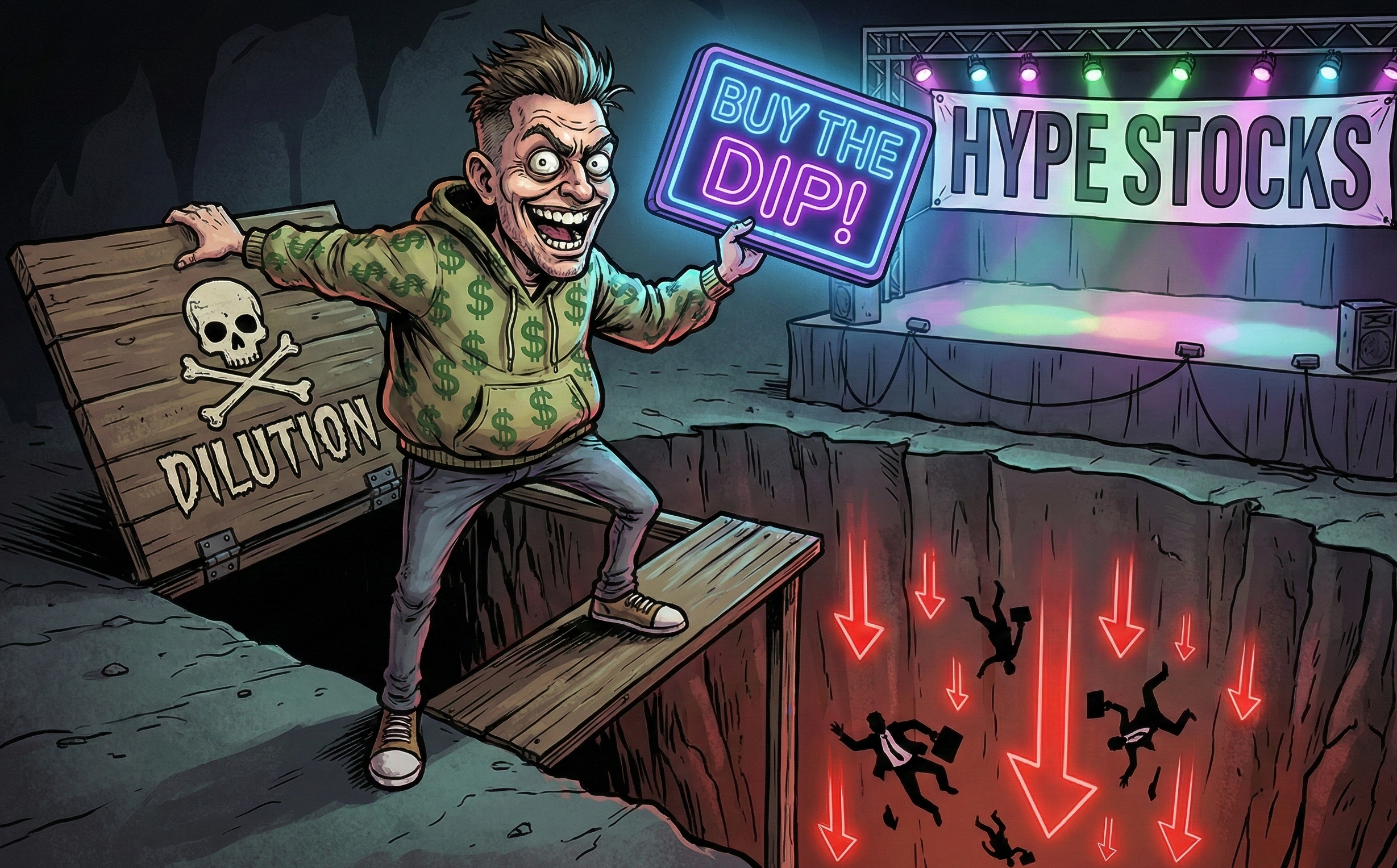

As a forensic equity researcher, I view the “Hype Cycle” not as an opportunity, but as a Liquidity Exit Event. In 2026, the retail trader is not the client; you are the product. You are the demand liquidity required for insiders to dump shares of insolvent companies before the music stops.

The influencer isn’t your friend. They are the marketing department for a dumping scheme. Their job is to keep attention high while the company funds operations with your capital through dilution.

2026 Insolvency Warning (Read This Before You “Buy the Dip”)

It’s January 2026. Rates are not your friend. The refinancing window that kept zombie companies alive in 2021 is closed.

Here is the part influencers “forget” to mention: Pre-revenue, negative-FCF companies cannot refinance debt in a high-rate environment without paying for it.

When a company has negative cash flow and a looming debt wall, they have three options:

- Refinance at a higher rate: Interest expense spikes, losses widen.

- Raise Equity (Dilution): They print massive amounts of new shares, shrinking your slice of the pie.

- Restructure: The polite word for “equity gets vaporized.”

In 2026, “we’ll refinance later” is not a strategy. It’s a prayer.

Metric #1: The Cash Burn Reality (Negative Free Cash Flow)

Influencers love “Revenue Growth.” It’s the easiest stat to screenshot. But revenue growth without cash generation is like bragging you’re eating more calories while bleeding out.

If a company generates $100 million in revenue but spends $150 million to keep the lights on, they are not a business; they are an arsonist.

How to audit this fast:

Skeptic’s Sidebar: “Revenue is vanity, profit is sanity, cash is reality.” If a company has been public for 5 years and still cannot generate a dollar of free cash flow, it is not a ‘growth story.’ It is a charity case.

Data Deep-Dive: The Dilution Death Spiral

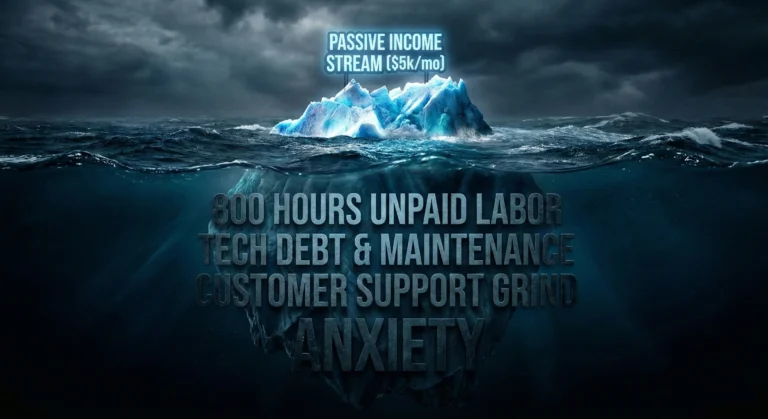

How do these zombie companies stay alive? They print shares. Here is the mechanism influencers hide: The Dilution Death Spiral.

- Company burns cash.

- Company issues shares (ATM program) to pay bills.

- Share count rises.

- Stock pops on hype → Insiders sell into the strength.

- Retail becomes the liquidity exit.

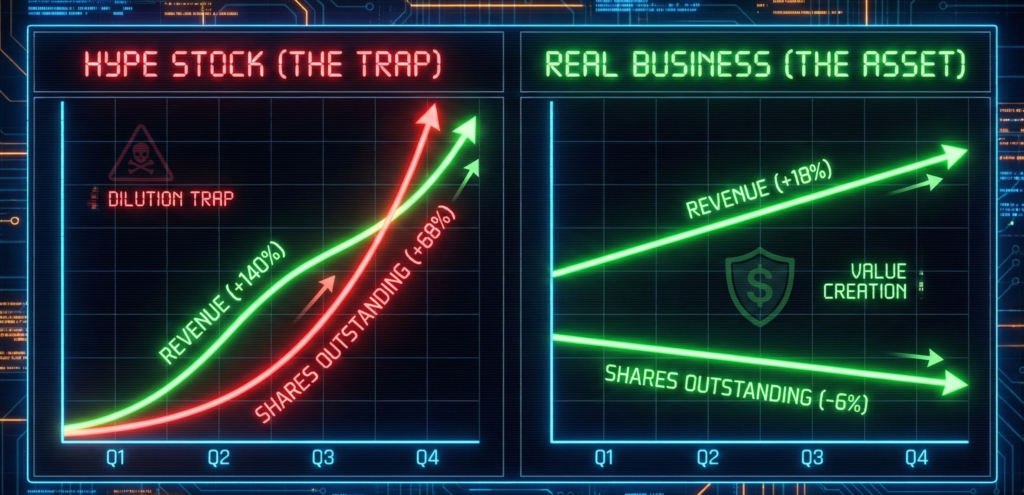

Hype Stock vs. Real Business (3-Year Audit)

|

Metric |

NanoHype Inc. (The Trap) |

Boring Ind. (The Asset) |

|---|---|---|

|

Revenue Growth |

+140% (The Hook) |

+18% (The Bore) |

|

Net Loss |

-$620M Loss |

+$1.9B Profit |

|

Shares Outstanding |

+68% Increase (Dilution) |

-6% Decrease (Buybacks) |

|

YOUR Share Value |

Diluted by 68% |

Concentrated by 6% |

The influencer says: “Look at the growth!”

The forensic analyst says: “Look at the per-share value.” If the market cap goes up but the share count goes up faster, the stock price goes down.

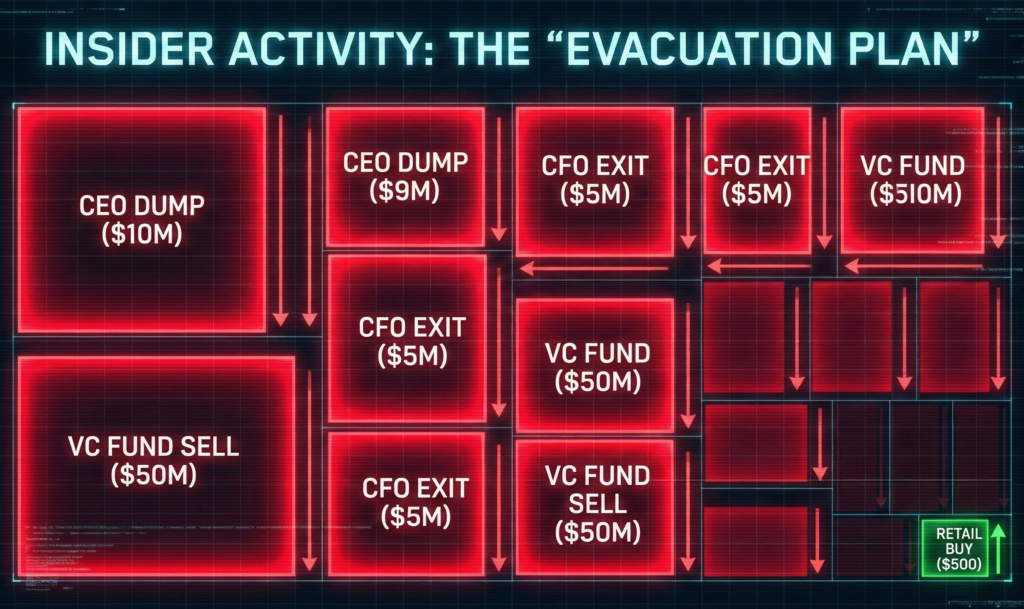

Metric #2: Insider Disposal (The “Skin in the Game” Lie)

Influencers love to say, “The CEO is a visionary! He believes in the mission!”

Does he? Stop listening to what they say on Twitter and start watching what they do on SEC Form 4.

Forensic Red Flags:

Skeptic’s Sidebar: If management believed the upside was asymmetric, they wouldn’t be racing you to the sell button.

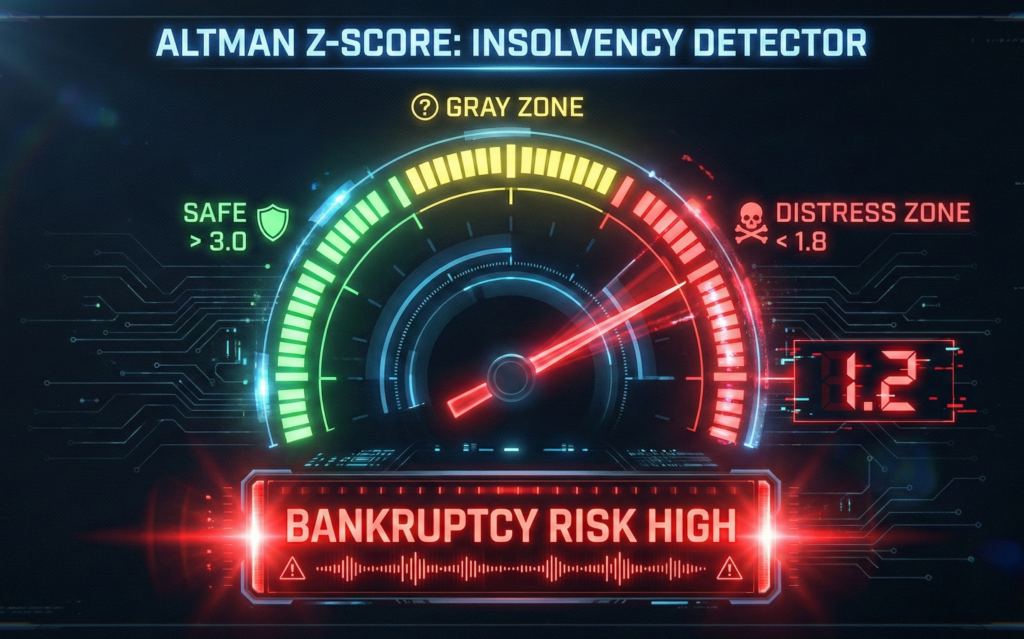

Metric #3: The Solvency Test (Debt-to-Equity & Altman Z-Score)

In 2026, solvency is binary. A company is either alive or it is dead. Narratives don’t pay debts.

To spot a bankruptcy risk before it hits the news, use the Altman Z-Score. It is a bankruptcy predictor that punishes weak balance sheets.

If your favorite AI stock has a Z-Score of 1.2, you aren’t buying a dip; you are buying a bankruptcy ticket.

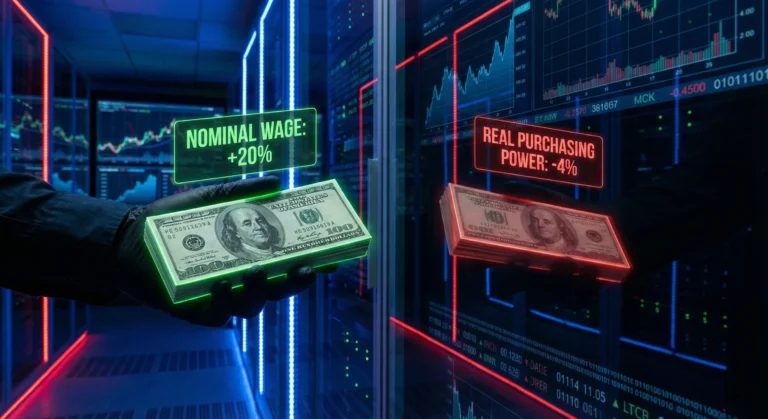

Metric #4: The Silent Thief (Stock-Based Compensation)

If there’s one metric that turns “adjusted profitability” into a comedy routine, it’s stock-based compensation (SBC).

SBC is routinely framed as “non-cash.” That’s technically true in the narrow accounting sense. Economically, it’s cash-like because it’s paid with something valuable: your ownership.

This is the stock-based compensation impact that gets buried:

SBC is fine when:

SBC is toxic when:

In those cases, SBC becomes a self-licking ice cream cone:

This is why a stock dilution audit must include SBC trends and share count changes, not just “EPS beats.”

Skeptic’s Sidebar: Calling SBC “non-cash” is like calling a stolen wallet “non-violent.” The damage is real.

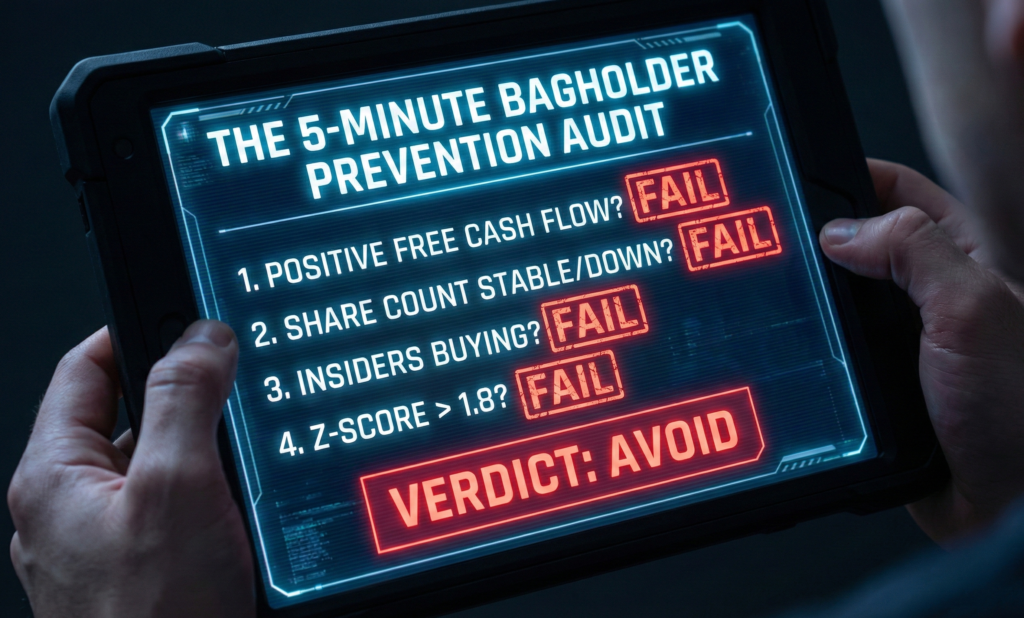

The “Bagholder Prevention Checklist” (The 5-Minute Audit)

You don’t need a Bloomberg terminal. You need discipline. Run this 4-step audit on Yahoo Finance before you buy:

- Cash Burn (FCF): Go to Cash Flow. Is Free Cash Flow negative with no improvement? FAIL.

- Dilution Check: Go to Statistics → Shares Outstanding. Is the share count line going up (e.g. +20% over 3 years)? FAIL.

- Insider Check: Search SEC Form 4. Are there repeated sales by the CEO/CFO with no buying? FAIL.

- Solvency Check: Is Debt rising while Cash is shrinking? Is the Z-Score < 1.8? FAIL.

If a stock fails 2 of these, the “upside” you are being sold is a trap.

Conclusion: The Unpaid Analyst Verdict

The stock market is a mechanism for pricing future cash flows. It is not a casino, and it is not a community project.

When an influencer tells you to “HODL” a company with massive debt, negative cash flow, and heavy insider selling, they are using you to soak up the supply so the pros can get out.

The Verdict: If the insiders are selling, why are you buying?

But don’t assume that simply retreating into the ‘safety’ of a broad market tracker is a foolproof escape; understanding why high-liquidity stocks are often safer than index fund delusions is the next step in protecting your capital from systemic rot

Actionable Advice:

Audit the Dilution. If the share count is rising

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment