The Stealth Default: How Inflation Liquidates Your Wealth to Fund the State

If you are reading the mainstream financial news on this morning of January 12, 2026, you are being lied to. They will tell you inflation is “sticky” or “stubborn.” They will blame supply chains, geopolitical friction, or corporate greed.

They are distracting you with economic weather reports while the foundation of your financial house is being deliberately undermined.

As a forensic investigator of macroeconomic policy, I don’t look at press releases; I look at monetary plumbing. The data tells a horrifyingly simple story: The United States government is mathematically insolvent. With national debt crossing $36 Trillion and interest payments consuming a terrifying percentage of tax revenue, the State has only one remaining playbook to avoid overt bankruptcy.

They have chosen the Stealth Default.

This is not an economic accident. It is a deliberate policy of financial repression. The goal is a massive national debt monetization: paying off yesterday’s bills with tomorrow’s devalued currency.

The Mechanics of Monetization (A Forensic Audit)

How does a government pay its bills when it spends trillions more than it collects?

In the old days, a king would clip the edges off gold coins, melt the clippings down, and mint new coins. The citizenry was left with debased currency, and the king got “free” money. Today, the process is digital and hidden behind terms like “Quantitative Easing,” but the mechanism is identical.

Here is the 5-step forensic cycle of monetization:

- The Deficit: The Treasury issues debt to fund spending that tax receipts cannot cover.

- The Buyer of Last Resort: The Central Bank buys those securities in the secondary market to keep the market “orderly.”

- The Injection: Payment is created as new bank reserves—money created out of thin air.

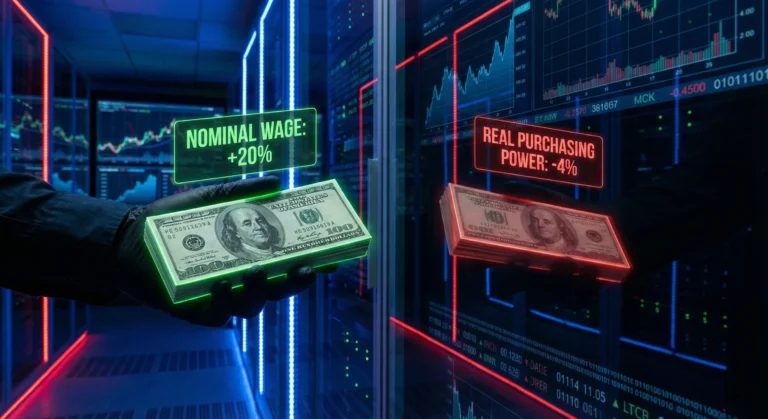

- The Cantillon Effect: New money pushes through markets first (assets, credit), then into goods, and finally into wages—late and insufficient.

- The Dilution: Every new dollar created dilutes the purchasing power of every dollar you worked to save.

They didn’t tax your income; they taxed your savings account.

Skeptic’s Sidebar: If you print money to pay a bill, you haven’t paid it. You’ve just diluted the shares of everyone else holding the currency. The debt wasn’t paid by the government; it was paid by the saver. Inflation is taxation without legislation.

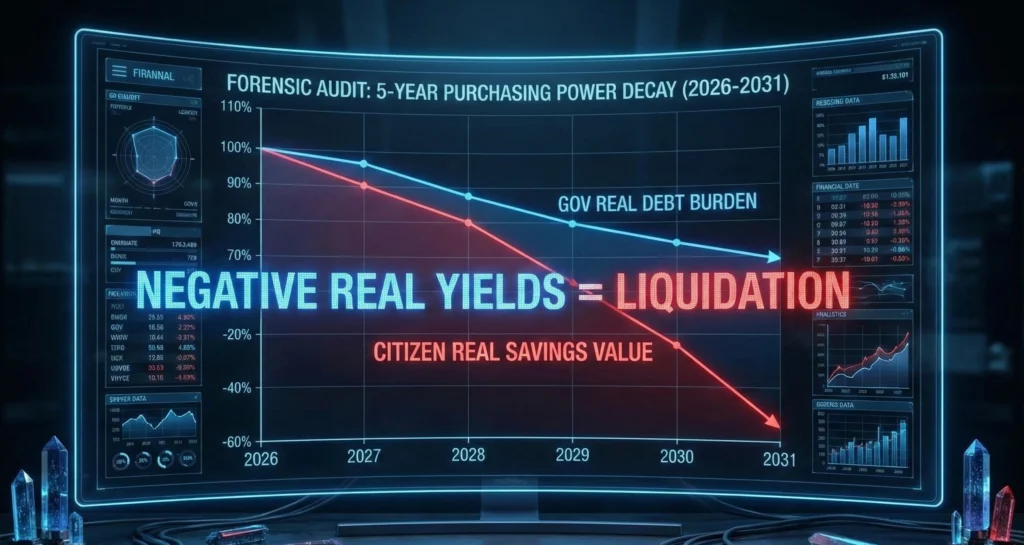

Data Deep-Dive: The Government’s P&L vs. Yours

Inflation is a zero-sum wealth transfer. When the policy target is “price stability” but the operational reality is “debt sustainability,” the citizen’s savings become the adjustment variable.

Let’s run a 5-year forensic projection. We assume a “sticky” inflation rate of 6% while the government holds nominal interest rates at 3% (Negative Real Yields).

5-Year Wealth Transfer: The Debtor vs. The Saver

|

Actor |

Initial Position |

Nominal Rate |

Real Inflation |

Real Value at Year 5 |

|---|---|---|---|---|

|

The State (Debtor) |

$36.0T Debt |

3% Cost |

6% |

≈ $31.2T (In Yr-0 Dollars) |

|

The Citizen (Saver) |

$100,000 Savings |

3% Yield |

6% |

≈ $86,800 (In Yr-0 Dollars) |

How the math works (no poetry, just arithmetic):

Nominal debt grows by interest:

$$ 36\text{T} \times 1.03^5 \approx 41.7\text{T nominal} $$

But the price level rises:

$$ 1.06^5 \approx 1.338 $$

Real debt burden:

$$ \frac{41.7\text{T}}{1.338} \approx 31.2\text{T} \quad \text{(in Year-0 purchasing power)} $$

The state’s “real” debt shrinks even while the nominal number grows. That’s the stealth default: the debtor improves its position by degrading the unit of account.

For the saver:

Savings grow nominally:

$$ 100,000 \times 1.03^5 \approx 115,900 $$

Adjust for inflation:

$$ \frac{115,900}{1.338} \approx 86,800 $$

The saver did “everything right,” accepted “safe yield,” and still lost ~13% of purchasing power over five years. That’s not misfortune. That’s the system functioning as designed.

Skeptic’s Sidebar: When the policy target is “price stability,” but the operational target is “debt sustainability,” the citizen’s savings become the adjustment variable.

This is why debates about whether CPI is 4.8% or 5.3% miss the point. If your nominal return is capped below your lived inflation rate, you are being harvested.

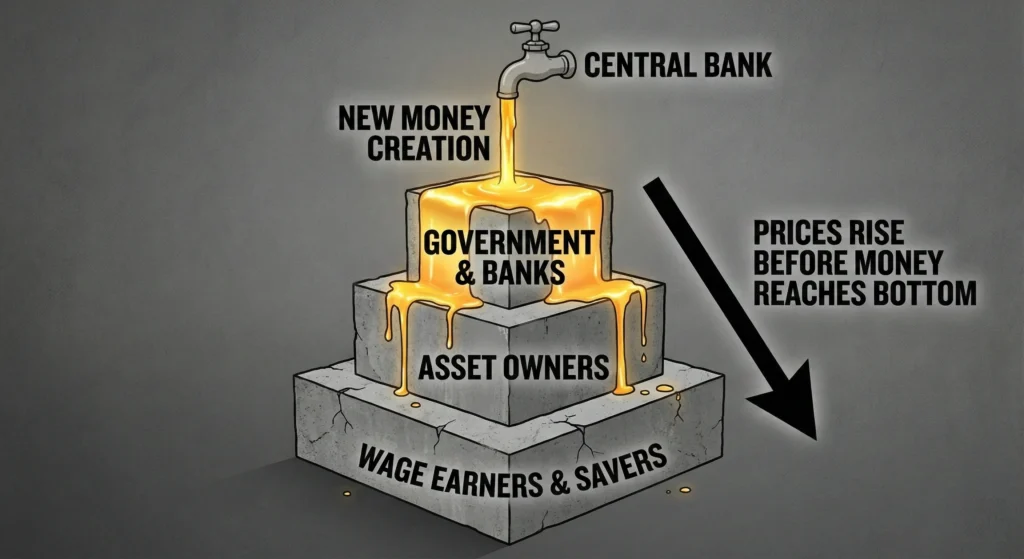

The Cantillon Effect (Why You Lose First)

The public is told inflation is “rising prices.” The more accurate description is that new money enters somewhere, benefits someone first, and only later raises prices for everyone else. That sequencing is the Cantillon effect explained.

Who gets the new money first?

- The sovereign (deficit spending),

- the banking system (credit creation),

- large asset holders (financial markets),

- contractors and politically connected sectors,

- finally, wage earners and fixed-income households.

This is why inflation feels like a rigged treadmill. The early recipients buy assets before prices adjust. The late recipients pay the higher prices without receiving the early gains. It is not merely “inequality.” It is a distributional policy via monetary plumbing.

Skeptic’s Sidebar:

Inflation is not neutral. It is a transfer mechanism disguised as a macro statistic.

When you hear “the economy is strong” because asset prices are up, translate it: the system is rewarding those closest to the spigot. When you hear “wages are rising,” ask: rising relative to what—your rent, your insurance, your taxes, your groceries, your child care, your energy?

The 2026 Financial Repression Playbook

As of January 2026, the debt math has moved from a “policy preference” to a “mathematical constraint.” The government must run negative real yields.

If interest rates rose to match the true rate of inflation (8-10%), the interest payments alone would consume the entire federal budget. The government would default overnight. To prevent this, they use Financial Repression:

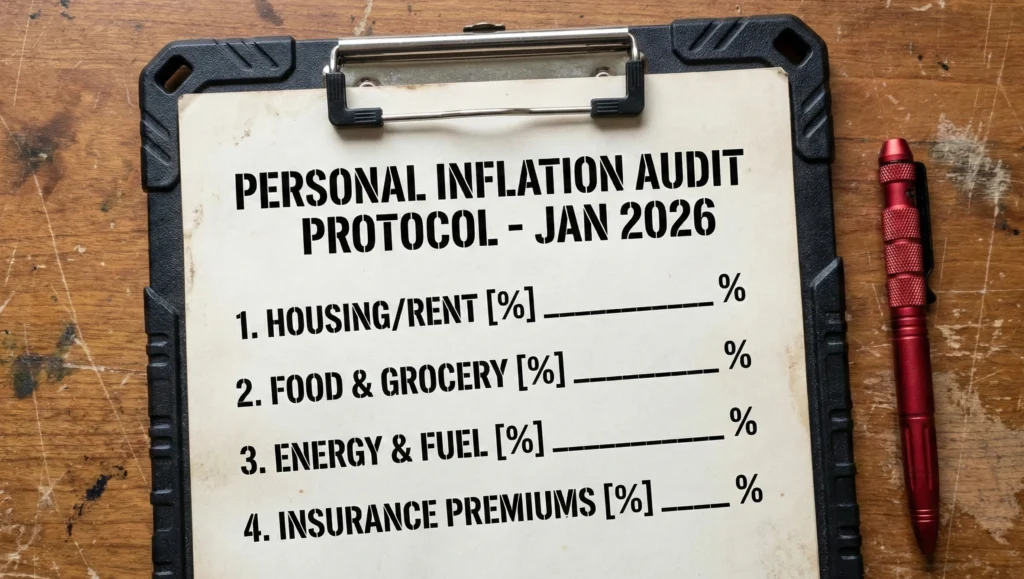

The “Personal Inflation Audit” (The 5-Minute Calculation)

The official CPI is an average, and you do not live an “average” life. To protect yourself, you must calculate your Personal CPI using a weighted model:

- List your Core 4: Housing, Food, Energy, and Insurance.

- Weight them: If Housing is 40% of your spend, weight it 0.4.

- Audit the Bills: Look at your year-over-year increases (e.g., Insurance premium +15%, Rent +8%).

If your “safe” savings yield 4% but your Personal CPI is 9%, you are losing 5% of your life’s work every single year.

Skeptic’s Sidebar:

The state doesn’t need to seize your account. It only needs to ensure your unit of account melts faster than your yield.

Conclusion: The Unpaid Analyst Verdict

The “Stealth Default” is not a conspiracy; it is a mathematical necessity for an insolvent state. They cannot tax or cut their way out of $36 Trillion. They will choose the path of least resistance: debasing the unit of account.

The inflation you feel is not a “bug” in the system; it is the feature that balances the government’s books.

The Verdict: You are the collateral.

Actionable Posture:

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

2 Comments