The Passive Income Delusion: Why Your “Sleeping Money” Is Actually Working 80 Hours a Week

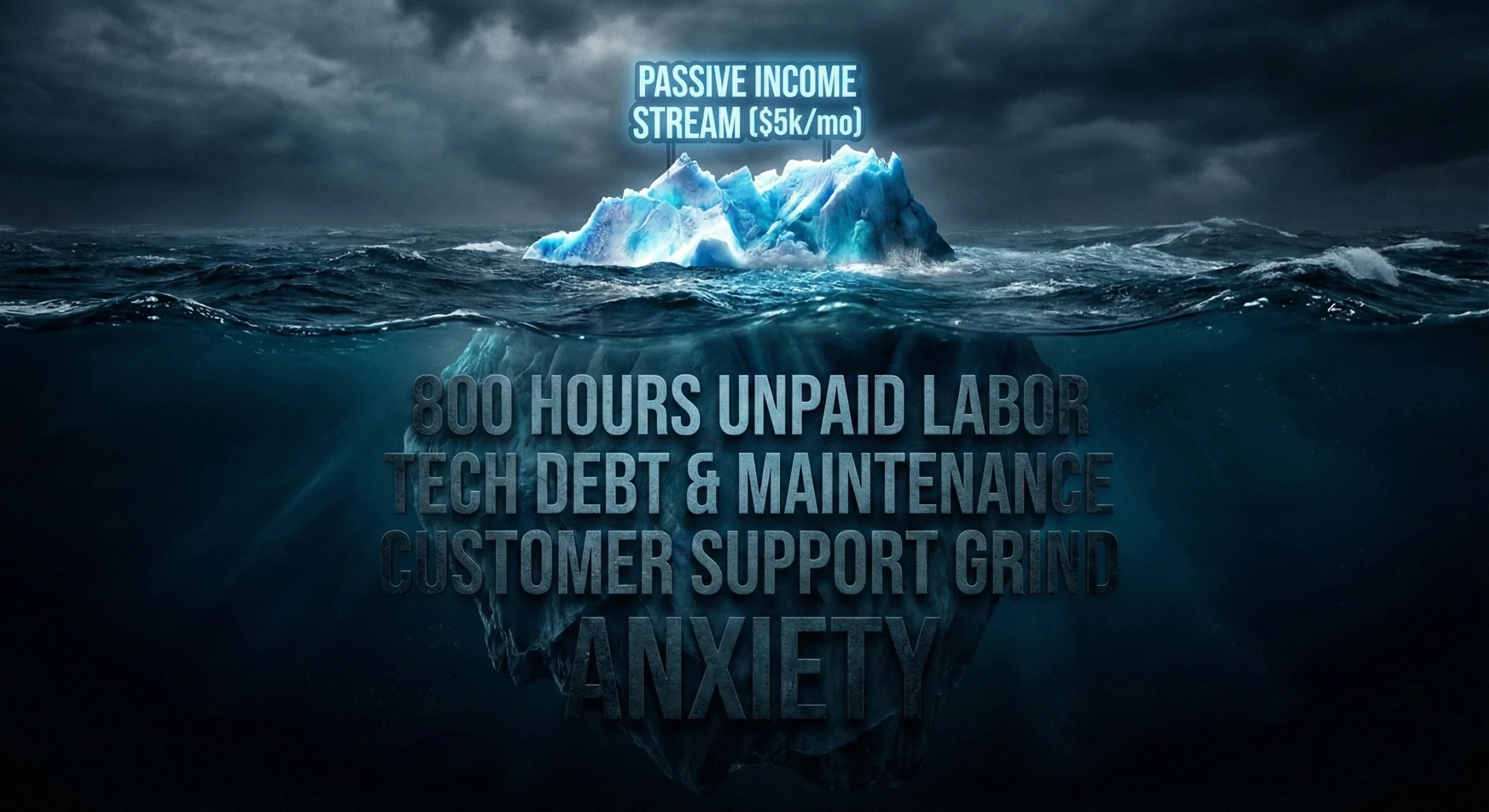

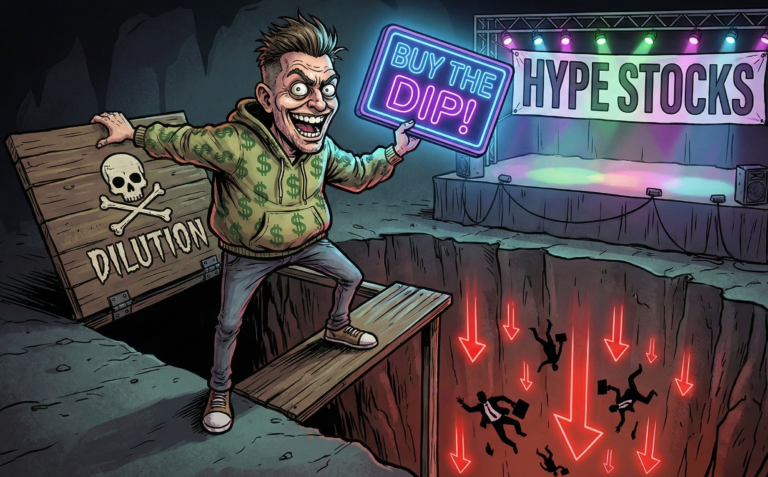

Here’s the uncomfortable truth no one selling a webinar wants to admit: most passive income is not passive. It is deferred labor, disguised as freedom, and aggressively marketed to people who are already tired.

This is the passive income delusion—the belief that money can flow effortlessly while you sleep, travel, or “escape the rat race,” with minimal skill, capital, or ongoing effort.

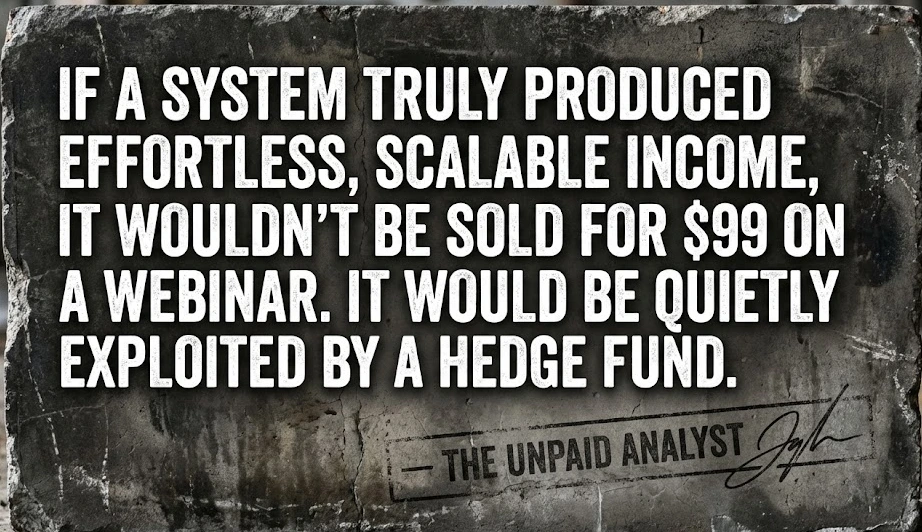

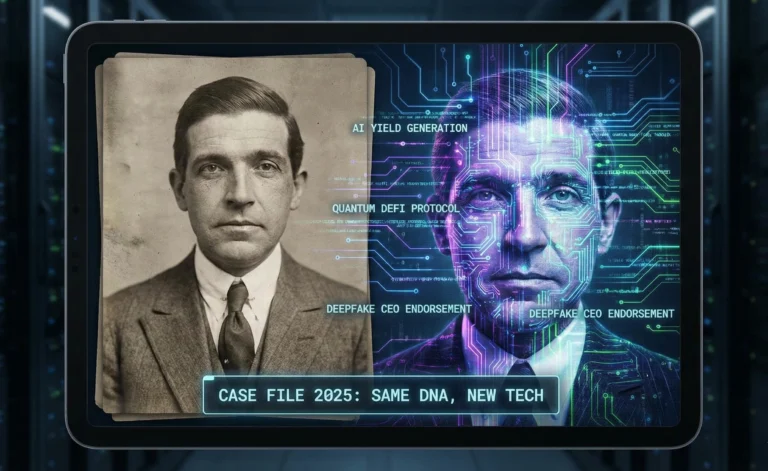

In reality, what’s being sold isn’t wealth creation. It is a Hope Arbitrage. Influencers monetize your exhaustion by repackaging hard work as lifestyle freedom. They blur the line between building an asset and owning one. That distinction matters more than any spreadsheet projection.

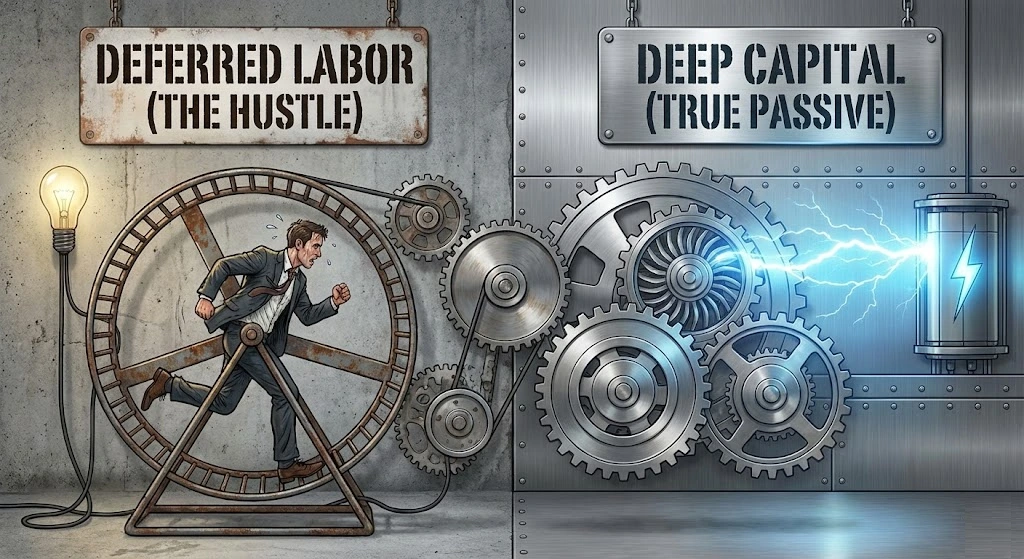

Let’s be precise. True wealth generation comes from either Deep Capital (money working) or Rare Expertise (leverage). Marketing hype comes from screenshots, gross revenue numbers, and carefully edited timelines that omit years of unpaid labor.

This article exists to do one thing: debunk the passive income delusion using data, not vibes. We’ll analyze the time cost, the hidden financial leakage, and why many people accidentally build themselves a second, lower-paying job.

The Time Audit: “Just Set It Up Once”

Every passive income pitch starts with the same phrase: “Just set it up once.” What they mean is: work like a founder for free and call it optional.

Let’s break down the Time Cost of Passive Income, because time—not money—is the real currency being quietly drained.

Case Study A: The “Niche Site” SEO Trap

You’re told to “write a few articles and let SEO do the rest.” Let’s run the timesheet:

The Math: Before your first meaningful dollar, you are often 600+ hours in the hole. If you value your time at a modest $50/hour, you have invested $30,000 of sweat equity. If the site makes $500/month, your “break-even” point is 5 years away.

Case Study B: The Digital Product (“Sell Knowledge Forever”)

Reality check on the “Course Creator” lifestyle:

- Curriculum Design: 40+ Hours.

- Recording & Editing: 80+ Hours (Audio fails, lighting fails, reshoots).

- The Funnel: Email sequences, landing pages, lead magnets.

- The Churn: Students demand refunds. Links break. Information becomes outdated.

Skeptic’s Sidebar: Automation is a myth. Software breaks. APIs change. Ads fatigue. Suppliers fail. You aren’t sleeping; you are firefighting.

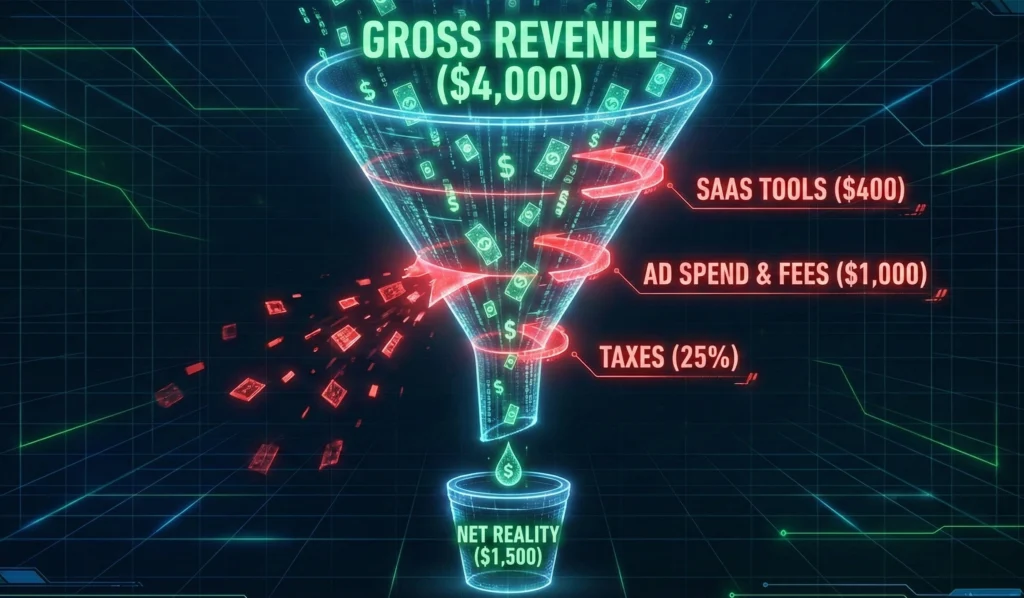

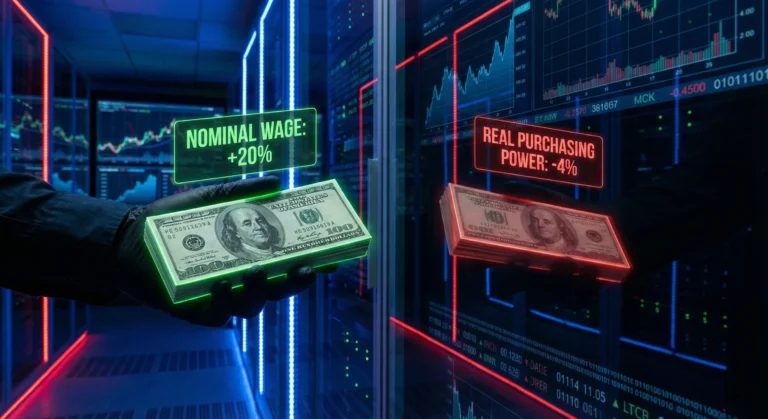

The P&L Reality: Gross vs. Net

Once the time cost is ignored, the next trick is focusing on Gross Income instead of Net Reality. This is where most financial projections quietly collapse.

Almost every so-called passive income stream bleeds money through “Silent Expenses.”

Let’s model a typical “Passive” Side Hustle:

|

Expense Category |

Monthly Cost |

Notes |

|---|---|---|

|

SaaS Stack |

$400 |

Hosting, Email (ConvertKit), Automation (Zapier), Analytics. |

|

Customer Acquisition (Ads) |

$800 |

If you don’t pay for traffic, you pay in time. |

|

Maintenance/Contractors |

$300 |

Fixes, design tweaks, virtual assistants. |

|

Merchant Fees |

$200 |

Stripe/PayPal take 2.9% + 30¢ off the top. |

|

Taxes (Self-Employment) |

$800 |

The government is your silent partner (approx 20-30%). |

|

TOTAL EXPENSES |

$2,500 |

The Result:

That is a 62.5% reduction from the headline number. And that is before counting the 20 hours a week you spend managing it.

The Real Estate Myth: “Tenants Pay Your Mortgage”

Real estate is crowned as the gold standard. “Buy a rental, and the tenant buys your freedom.” This narrative collapses under a simple concept: CapEx (Capital Expenditures).

Let’s dissect the Debunking Rental Property Income Myth.

Beyond the mortgage, you are subject to the 3 D’s of Real Estate:

- Damage: Tenants destroy things. Storms destroy things.

- Decay: A roof lasts 20 years. An HVAC lasts 15. You must reserve $200-$400/month for these future “bombs.”

- Default: Eviction is expensive, legally complex, and results in 0% income for months.

The “Passive” Dilemma:

Skeptic’s Sidebar: Many small landlords do not own assets. They own a second job where the boss (the bank) gets paid first, and the customer (the tenant) can legally refuse to pay you.

Does “Real” Passive Income Exist?

After torching the straw men, what is left? Yes, passive income exists—but it requires Deep Capital, not “hustle.”

True Passive Vehicles:

- Dividends / Index Funds: The companies have employees; you just hold the paper. (Requires massive capital for livable income).

- Government Bonds: The risk-free rate. (Boring, low return).

- Royalties / Patents: The result of Rare Expertise. You front-loaded excellence for a decade, and now you get paid.

The Unpaid Analyst Distinction:

If you don’t have capital, you cannot have passive income. You can only have deferred labor.

Conclusion: The Verdict

The promise of effortless income survives because it preys on fatigue. People don’t want riches—they want relief. The market knows this and sells narratives instead of numbers.

The passive income delusion isn’t that money can’t work for you. It’s that work can be eliminated. It can’t. It can only be hidden, delayed, or outsourced.

Actionable Advice:

- Stop chasing “Sleeping Money.”

- Start building High-Value, Active Skills.

- Use Data, not Dashboards.

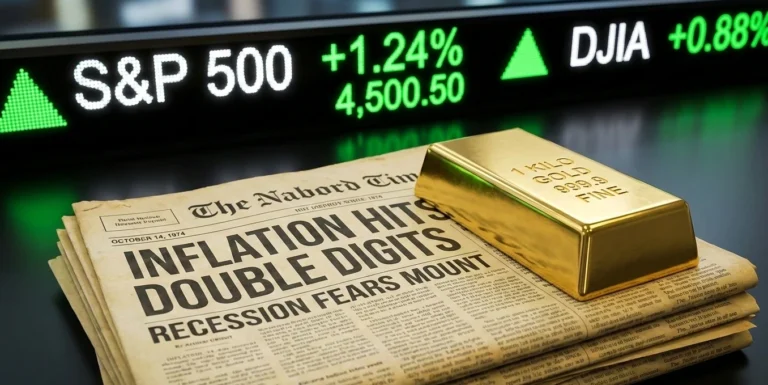

Skeptic’s Appendix: The Fear-to-Fraud Pipeline The market for these delusions thrives on your exhaustion and your fear. If you find yourself chasing ‘automated systems’ because you’ve been spooked by the media’s constant stock market crash 2025 predictions and the hidden cost of market timing, realize that you are simply trading one form of volatility for a much more dangerous form of insolvency. Real wealth isn’t built by hiding from market corrections in ‘passive’ traps; it’s built by staying invested in productive assets while the ‘Fear Industry’ screams for your attention.

Financial independence is not found in shortcuts. It’s found in clarity, patience, and realism.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment