The Rotting Asset Thesis: Why Building Depreciation Destroys Wealth Faster Than Mortgage Interest

The most persistent lie in housing is that a house is a ‘savings account.’ A proper real estate depreciation analysis reveals the truth: you are buying a rotting asset. That slogan survives because it’s emotionally satisfying and arithmetically lazy.

If you want a real estate ROI reality check, stop reading listings and start reading balance sheets. A proper real estate depreciation analysis starts with a blunt split: you aren’t buying a “home”; you are buying land value vs. building value. You are buying a plot of dirt (the only part that can plausibly appreciate) bolted to a physical structure that is guaranteed to decay.

In 2026, the hidden costs of property investment are no longer “unexpected.” They are scheduled. The building is a consumable with a long fuse. The land is the asset; the structure is the liability you must continuously refinance with repairs.

The Depreciation vs. Interest Math: The Silent Killer

Most investors obsess over their mortgage rate. They spend weeks shopping for a 0.1% discount, terrified of the “dead money” that is interest. But mortgage interest is honest. You see it every month. It is front-loaded, predictable, and contractually fixed.

Depreciation is a stealth tax. It is the invisible accumulation of entropy.

While mortgage interest is a known stream, depreciation is a known cliff disguised as randomness. Consider the “balloon payments” most investors ignore:

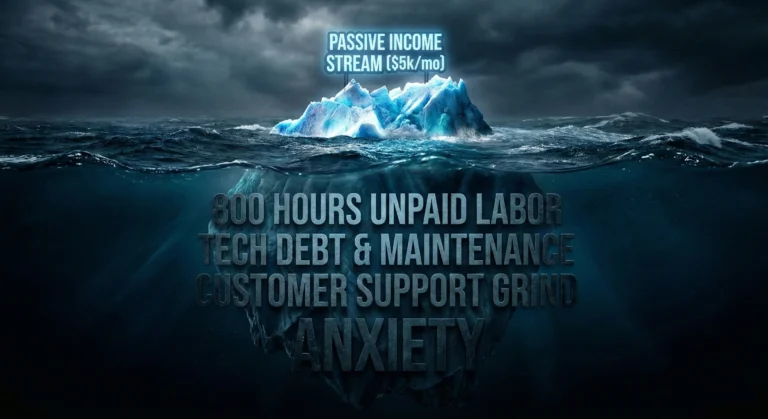

While you are celebrating $500 in monthly “cash flow,” your property is quietly accumulating $800 a month in “Deferred CAPEX” (Capital Expenditures). You aren’t making a profit; you are simply cannibalizing the future value of your structure.

Skeptic’s Sidebar: Cash flow is a lie if you ignore CAPEX. If you withdraw $10,000 in “profit” from your rental this year, but your roof is five years closer to a $20,000 replacement, you didn’t make a profit. You just took a payday loan against your own equity.

Data Deep-Dive: The “Land vs. Lumber” Audit

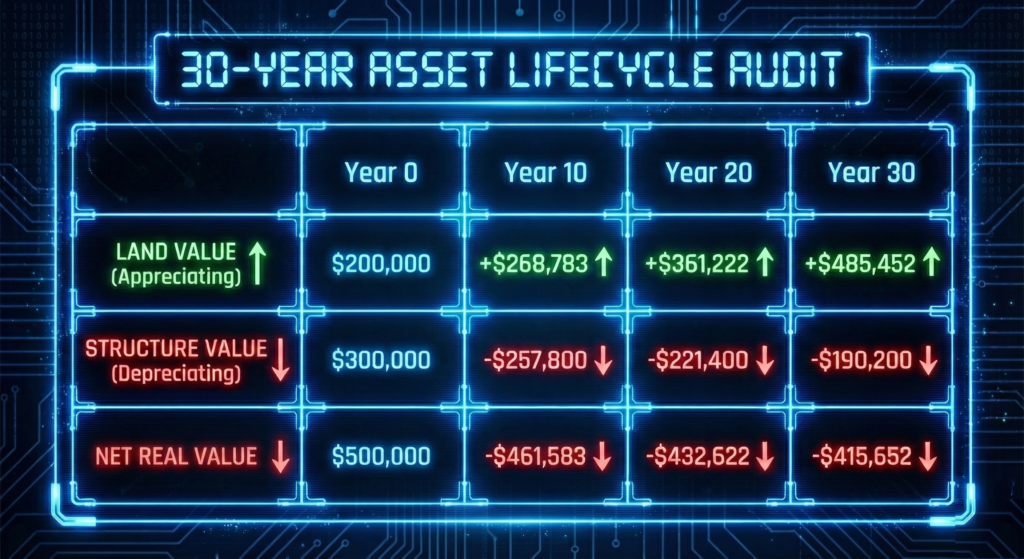

Below is a forensic 30-year decomposition. It isolates the physical asset effect to show how the dirt and the rot fight each other for your net worth.

The Scenario: A $500,000 property.

|

Year |

Land Value (Appreciating) |

Structure Value (Depreciating) |

Cumulative Maintenance (The “Rot” Tax) |

Net Real Value |

|---|---|---|---|---|

|

Year 0 |

$200,000 |

$300,000 |

$0 |

$500,000 |

|

Year 10 |

$268,783 (+34%) |

$257,800 (-14%) |

-$65,000 |

$461,583 (Real Loss) |

|

Year 20 |

$361,222 (+80%) |

$221,400 (-26%) |

-$150,000 |

$432,622 (Stagnant) |

|

Year 30 |

$485,452 (+142%) |

$190,200 (-36%) |

-$260,000 |

$415,652 (Net Loss) |

Note: The “Market Value” on Zillow might look higher due to currency inflation, but the intrinsic purchasing power of the asset has collapsed. To understand how price tags can rise while your actual wealth vanishes, you must understand how the government’s stealth default uses inflation to liquidate the value of your savings and your equity alike.

The Silent Killer: CAPEX Inflation in 2026

In 2020, replacing a water heater cost $1,200. In 2026, due to skilled labor shortages and material volatility, that same job is $2,800.

This is home maintenance inflation. The “1% Rule” is dead. In 2026, the true net rental yield calculation requires a replacement reserve that reflects structure value, not purchase price:

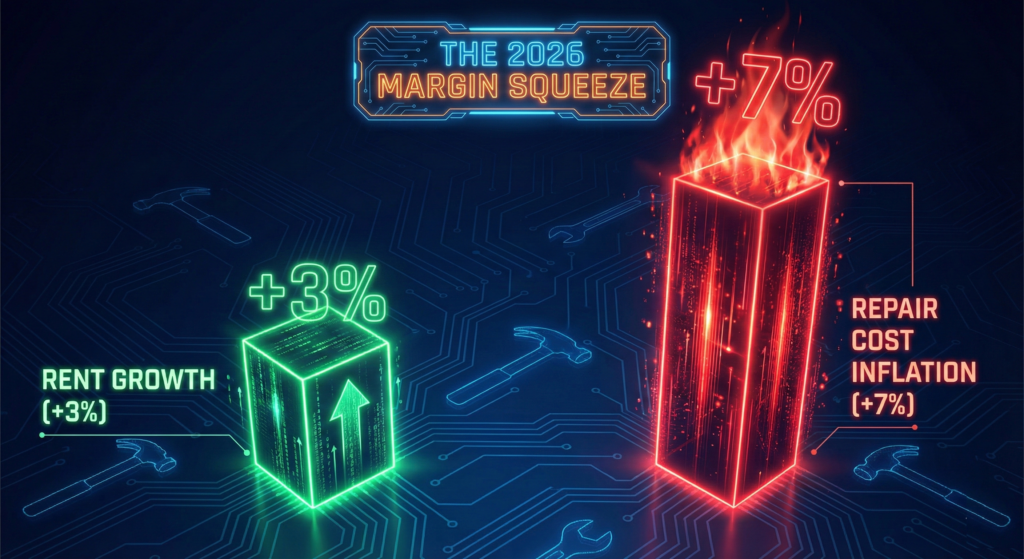

Rent growth is capped by what tenants can afford. But your maintenance costs are uncapped, driven by the scarcity of roofers, plumbers, and electricians. If your costs compound at 7% and your rent compounds at 3%, you aren’t an investor; you are an ATM for the trades.

The 2026 Insurance & Climate Crunch: The Gatekeeper

Insurance is no longer a boring expense line. It has become an asset viability gatekeeper. In 2026, rising premiums and outright uninsurability are accelerating functional depreciation.

Climate risk is an accelerated depreciation that the market hasn’t fully priced in yet.

- NOI Destruction: Every $1,000 increase in insurance premiums destroys roughly $15,000 in property value (at a 6.5% cap rate).

- Uninsurability as Obsolescence: If an insurer refuses to cover your 20-year-old roof or your electrical panel, your building becomes unfinishable and unsellable. That is functional death.

- Risk Transfer: With percentage deductibles (2%–5% of insured value) now becoming standard, you are self-insuring the “small” $15,000 losses.

Skeptic’s Sidebar: If a property is “cash flowing” only because you’re underinsured or ignoring the 20-year-old HVAC, you’re not earning yield—you’re selling disaster options for pennies.

Conclusion: Stop Buying Wood. Buy Dirt.

The “property always goes up” story is a marketing slogan stitched together from land scarcity and leverage. In a serious real estate depreciation analysis, the structure is not your wealth engine—it’s your maintenance obligation.

In 2026, the math is sharp:

The Unpaid Analyst Verdict: Stop obsessing over the pretty kitchen and the hardwood floors. Those are liabilities. They break, and they need insurance. Buy for the land-to-value ratio. Buy for the location.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment