The $5,000 Guru Tax: A Forensic ROI Audit of Financial Coaching

It is January 6, 2026. The “New Year, New You” marketing machine is running at maximum efficiency. Your social media feeds are likely flooded with sleek, high-production ads promising to unlock “financial freedom” or “escape the matrix” for the low, low price of $5,000.

They call it an “investment in yourself.” They frame it as a bargain compared to a college degree. They use high-pressure sales tactics to convince you that the only thing standing between you and a Lamborghini is their exclusive “Mastermind.”

But here is the forensic reality the financial coaching ROI analysis exposes: For the vast majority of buyers, these courses are not assets. They are liabilities.

In the 2026 economy, where information is free and AI can structure a syllabus in seconds, the “Guru Model” relies on information asymmetry that no longer exists. This article is a coaching course fee audit—a clinical breakdown of the hidden costs, the break-even math, and the devastating opportunity cost of the “Guru Tax.”

The Math of Mediocrity: The Guru’s Stealth Fees

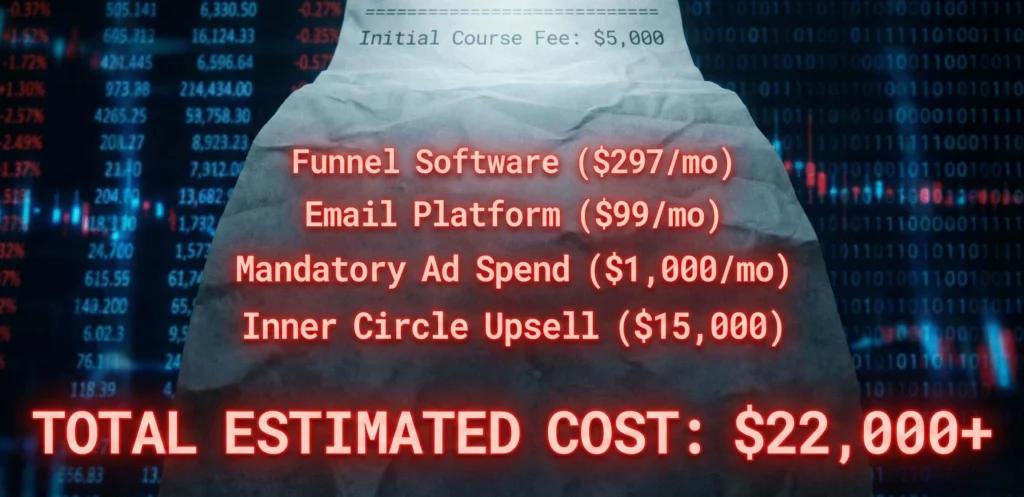

The initial sticker price—often $5,000 to $10,000—is rarely the final cost. In the “Biz-Op” (Business Opportunity) industry, the initial course is simply a “tripwire” designed to qualify you for further spending.

A proper coaching course fee audit reveals the “Stealth Stack” that kills your ROI before you launch. It’s not just $5,000; it’s a monthly bleed evidenced by the receipts they don’t show on the sales page:

- The “Tool Tax” ($300–$500/mo): Most courses mandate specific software stacks that have affiliate ties to the Guru.

- Funnel Builder: $297/mo

- Email Autoresponder: $99/mo

- “Exclusive” Plugins: $49/mo

- The Ad Spend Trap ($1,000+/mo): The strategy usually relies on “paid traffic.” You are told you need to “feed the machine” to get data. If you don’t spend, they say you “didn’t implement.”

- The Upsell ($15,000+): Once you are in, you are told the “real” secrets are in the “Inner Circle” or “Done-For-You” package.

By Month 3, you haven’t just spent $5,000. You have spent $8,000+ and haven’t earned a single dollar of profit.

Skeptic’s Sidebar: “An ‘investment in yourself’ that requires a high-interest credit card balance is just a debt-financed gamble with a 0% guaranteed return.”

Data Deep-Dive: The Break-Even Horizon

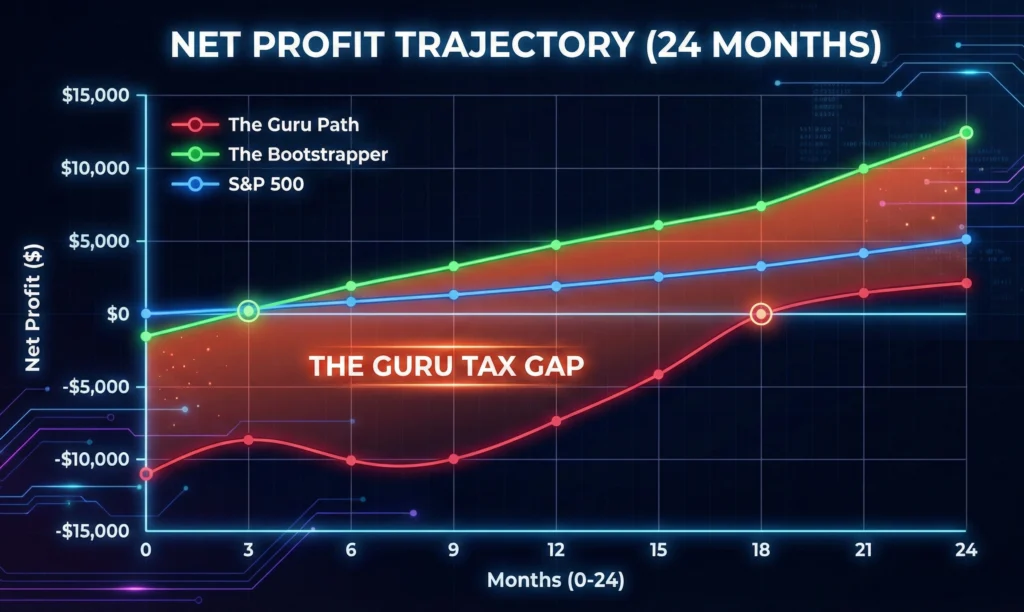

Let’s run the numbers. We will compare two paths: the “Guru Path” (High-ticket course) vs. the “Bootstrapper Path” (Books, free documentation, and execution).

The critical metric here is Net Profit vs. Course Cost. Most new businesses operate at a 10%–20% net margin if they are lucky. The chart below visualizes how deep the financial hole becomes on the Guru Path versus the lean approach.

The Break-Even Analysis Table (2026 Outlook)

|

Investment Type |

Initial Fee |

Hidden Costs (Year 1) |

Total Cash Outlay |

Revenue Needed to Break Even (at 20% Margin) |

Time to ROI |

|---|---|---|---|---|---|

|

The Guru Path |

$5,000 |

$6,000 (Tools/Ads) |

$11,000 |

$55,000 |

18–24 Months |

|

The Bootstrapper |

$200 (Books) |

$1,200 (Lean Stack) |

$1,400 |

$7,000 |

3–6 Months |

|

Index Fund |

$5,000 |

$0 |

$5,000 |

$0 (Passive) |

Immediate |

The Forensic Verdict: To justify a $5,000 course, you don’t need to make $5,000. You need to generate $55,000 in gross revenue just to pay back the principal and the overhead required to run the “system.”

Most students never reach $55,000 in revenue. They hit the “churn wall” at Month 4, give up, and the Guru keeps the $5,000 as pure profit.

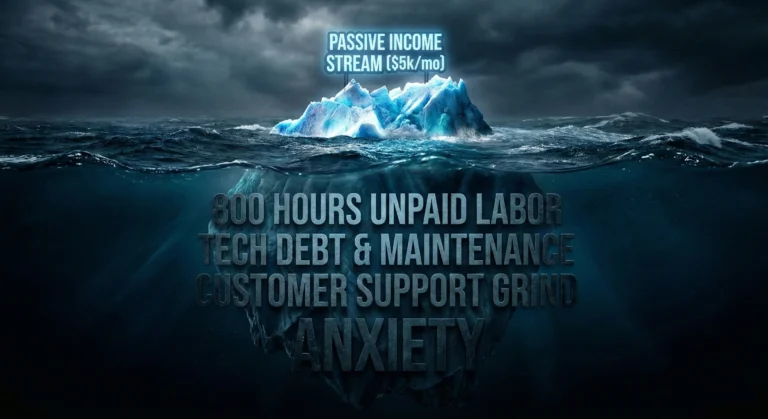

The Opportunity Cost of “Education”

The educational opportunity cost is the silent killer. That $5,000 isn’t just cash; it is capital that could have been deployed into proven assets.

If you invested that $5,000 into the S&P 500 (historically ~10% nominal return) or a high-yield savings account (even at 4%), it starts compounding immediately.

But there is a darker opportunity cost: Time.

Most “Guru” programs require 20–30 hours a week of “hustle”—building funnels, cold DMing, creating content.

If the business fails (statistically, 90% do), you haven’t just lost money. You have vaporized six months of life and $20,000 in comprehensive value.

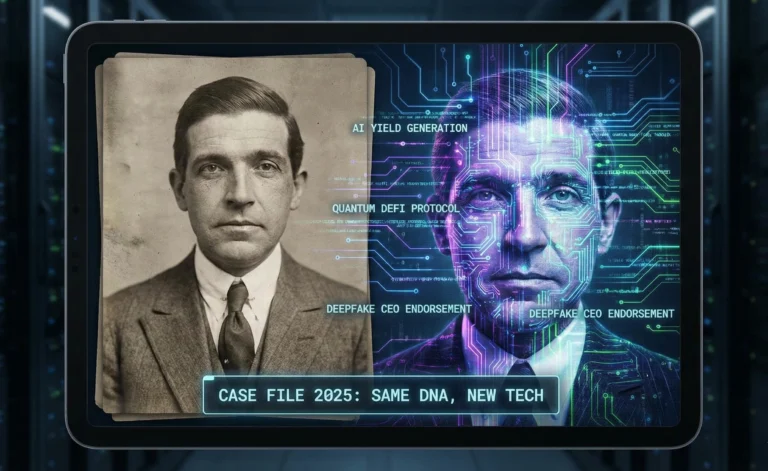

High-Ticket Red Flags: The DNA of a Guru Trap

How do they sell this? By bypassing your logical brain (the prefrontal cortex) and targeting your lizard brain (the amygdala). Look for these high-ticket coaching red flags:

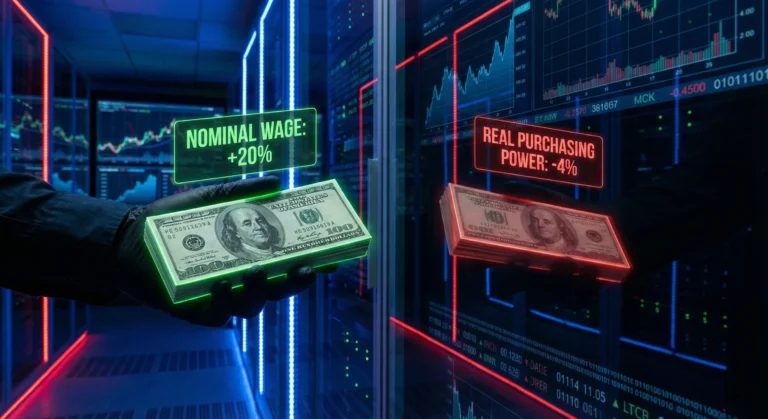

- “Income Claims” without P&L Sheets: Screenshots of Stripe dashboards show Revenue, not Profit. A $100,000 month means nothing if you spent $90,000 on ads and refunds.

- Scarcity Anchoring: “Only 3 spots left!” or “Price doubles at midnight!” (In 2026, digital goods have infinite supply. Artificial scarcity is a manipulation tactic.)

- The “Vehicle” Shift: They attack traditional paths (college, 401ks, jobs) as “scams” or “The Matrix” to position their specific, unproven business model as the only lifeboat.

While these tactics are specific to the coaching industry, they are part of a broader psychological playbook used by scammers across the financial spectrum. To protect your capital from more sophisticated traps, you should cross-reference this audit with our comprehensive guide on identifying common investment fraud red flags before you commit a single dollar of capital to an ‘unmissable’ opportunity.”

The 2026 Warning: The “AI Slop” Saturation

Warning for Early 2026: The landscape has shifted dangerously this year. In 2024–2025, Generative AI lowered the barrier to entry for content creation, creating a perfect storm of saturation.

The market is now flooded with “coaches coaching coaches” and AI-generated courses.

The Caution: If a course promises to teach you how to “Use AI to make money,” pause. If it was truly effortless, the AI would be doing it for them, not generating sales copy to sell you the method.

Conclusion: The Unpaid Analyst Takeaway

There is a difference between Education (learning a skill like accounting, coding, or data analysis) and Opportunity (buying a “system” to get rich).

Skills are assets. “Systems” sold by Gurus are liabilities.

If you have $5,000 burning a hole in your pocket in January 2026:

- Pay off debt. (Guaranteed ROI).

- Buy the S&P 500. (Historical compounding).

- Buy books. (The original $20 mentorship).

But do not hand it to a stranger on the internet who promises to solve your life problems. If their “secret” was actually an infinite money glitch, they would be running a hedge fund, not a Facebook ad.

SYSTEM STATUS: ANALYST PROFILE

The Unpaid Analyst: Zero Agenda, Raw Data. Most analysts are paid to tell you exactly what you want to hear. I’m not. On this site, mainstream narratives are dismantled using cold math and the hard facts that the media ignores to keep the public comfortable. I don’t peddle dreams or “get-rich-quick” schemes. I deliver raw macroeconomic reality—because the truth doesn’t need a sponsor.

One Comment